- Dec 19,2018

- All | Audit / IFRS

Inventory Evaluation Process

Disclosure of the accurate value of inventory is very important for a business organization to give a true and fair picture of the financial position as well as the profit/loss account for a particular period. Verification of inventory and its valuation has a vital role in financial audit as well. Inventory is defined as assets that are intended for sale, are in process of being produced for sale or are to be used in producing goods.

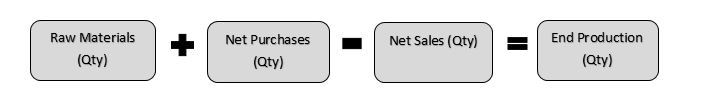

The following equation expresses how a company's inventory is determined:

Cost Inclusions:

- costs of purchase (including taxes, transport, and handling) net of trade discounts received.

- costs of conversion (including fixed and variable manufacturing overheads) and

- other costs incurred in bringing the inventories to their present location and condition.

Cost exclusions:

- Waste materials

- Storage facilities

- Administrative work unrelative to production

- Selling cost

- Differences in foreign currency billing

- Interest incurred when bills are postponed

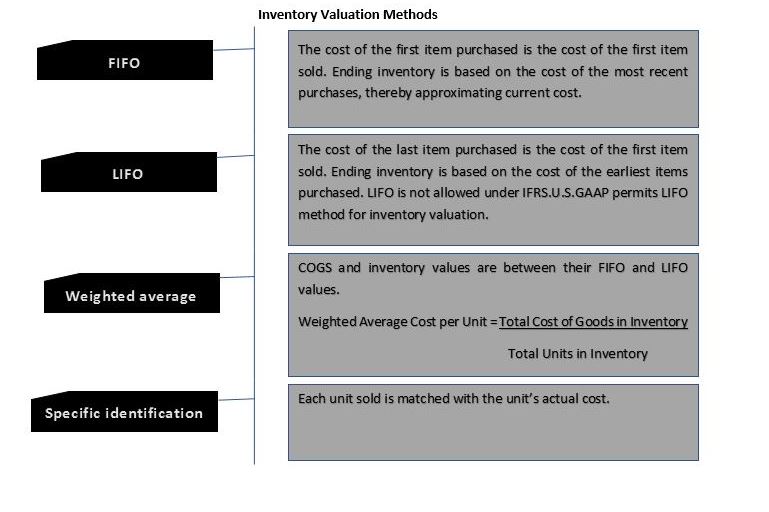

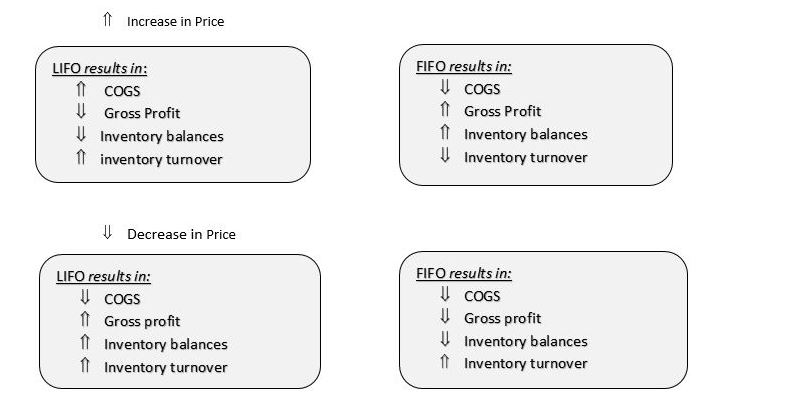

Now let us analyze what will be the impact on the value of inventory, profit, and other aspects while choosing different methods of valuation of inventory.

Under IFRS, inventories are valued at lower of the cost or net realizable value. Inventory write-ups are allowed, but only to the extent that a previous write-down on net realizable value was recorded. Under U.S. GAAP, inventories are valued at the lower of cost or market value. Market value is usually equal to replacement cost but cannot exceed net realizable value or be less than net realizable value less a normal profit margin. No subsequent write-up is allowed. Inventory is one of the major assets in the statement of financial position of trading and manufacturing companies.

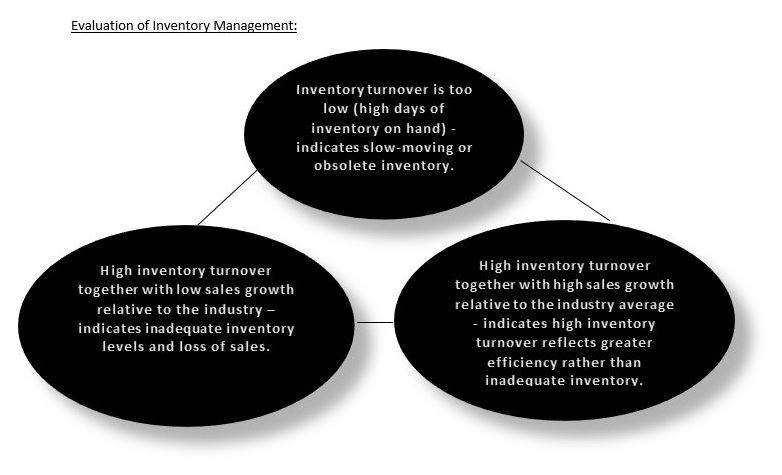

While valuing the business it is one of the important aspects to be considered. The valuation methodology is very important for both buyer as well as seller.