What is Value Added Tax in UAT(VAT in UAE) & how does it work?

VAT in the UAE is a type of general consumption tax which is collected incrementally based on the value-added at each stage of production or sales. VAT is an indirect tax also known as the consumption tax. It is charged at each stage of the supply chain where the end-users have to ultimately pay the tax. VAT is imposed on most supplies of goods and services that are bought and sold or consumed.

Why VAT?

The commencement of VAT in the UAE will help the government to reduce its dependence on oil and other hydrocarbon products as a source of their revenue. This would increase its wealth which would get the country better equipped and render superior amenities. With VAT’s commencement in the UAE, it is estimated to generate AED 12 billion in the first year 2018 and AED 20 billion in 2019. The International Monetary Fund has estimated, the UAE’s inflation to reach 3.6 per cent next year in 2018, which is almost 80 basis points higher than the estimated 2.8 per cent this year in 2017.

VAT in the UAE & its Categories.

In the UAE, VAT is all set to be executed from 07:00 AM on 1st January 2018. The GCC (Gulf Co-operation Council) countries have agreed ‘in principle’ to the GCC VAT Agreement to apply VAT in the region at a standard rate of five percent. In the GCC, Saudi Arabia and the UAE will be the first two countries to launch VAT from January 1, while other GCC countries will follow the same in the coming years.VAT shall be applicable on almost all the daily basic consumable goods and services that the inhabitants consume on a daily basis. VAT is one of the most common types of indirect tax which has been adopted by more than 150 countries around the world.

VAT is categorized as

- Standard Rate: Standard Rate is a supply on which tax is charged at 5% and for which the related input tax is deductible. All supplies other than the goods/services which are not mentioned below in Exempted & Zero Rated are Taxable at a Standard Rate.

- Exempted: An exempt supply is a supply on which tax is not charged and for which the related input tax is not deductible.

What sectors will be Exempted?

- Local passenger transport

- Bare land

- Certain financial services

- Supply of Residential buildings

-

Zero Rated:

- A zero-rated supply is a taxable supply on which tax is charged at 0% and for which the related input tax is deductible.

What sectors will be Zero Rated?

- Exports

- International Transport of passengers and goods

- Investment in gold, silver, and platinum

- Residential Buildings (First sale or lease within 3 years)

- Certain Education Services

- Healthcare Services

- Medicines & Medical Equipment.

- Crude Oil & Natural Gas

What changes will VAT invite in the UAE?

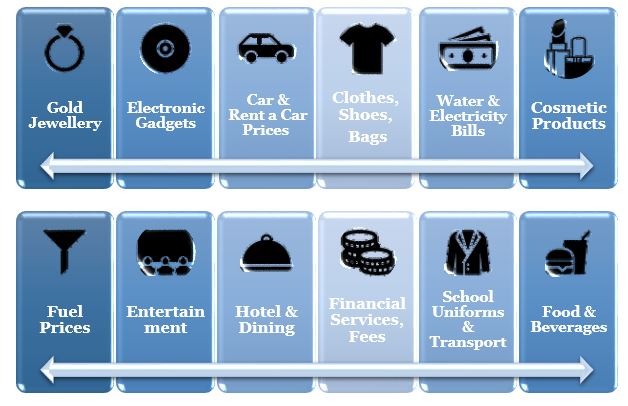

In the UAE prices will soar up by five per cent for the below-mentioned goods and services which will include food and beverages, utility bills, private transport services, hotel services, entertainment, electronics, school uniforms, commercial rents, cars and jewellery among others.

What will NOT change despite of VAT implementation in the UAE?

The categories that are zero-rated or exempted from VAT on which tax will not be charged are healthcare services, medicines, tuition fees, local transport, residential rents, surgery and certain government services.

How will VAT in the UAE impact your cost of living?

According to the experts, residents having a lower income of less than AED 5,000/- will not have much difference in their cost of living. The application of VAT rate at five percent is also one of the lowest in the world. However, it is to be noted that middle-class residents earning AED 20,000/- and above is likely to incur more impact on their cost of living as their expenses will likely increase.

But at the same time, higher-earning class residents will not have much impact on VAT’s implementation because of the minimum rate. However, the ministry has issued a strict warning of a hefty fine of AED 100,000/- for the suppliers and retailers if they happen to raise the prices of the products for more than the prescribed rate of VAT. The ministry has also assured to initiate surprise inspections to check if the implementation of VAT is going the right way.

What does Executive Regulation of VAT in the UAE NOT enlighten us with?

(Source ~ Khaleej Times)

On Healthcare:

The Executive Regulation not yet clarified the list of healthcare services that will be zero-rated. The list of pharmaceutical products or medical equipment which will be zero-rated is not yet listed too. Hence, the healthcare industry waits for some more clarity.

On Local Passenger Transport:

The Executive Regulations does not give much clarity on third-party transport companies who provide transportation for school pick - up and drop - off services to the staff and students. Whether this service of transportation will fall under the exempt category or local passenger transport is not yet clarified.

On Designated zones:

As supply of goods and services from the mainland to designated zones and from designated zones to the mainland is taxable. The Executive Regulation on designated zones does not clarify the process on how VAT will be accounted in case of the supply of goods by a company or a person in a designated zone to a company or a person in a non-designated zone or in the mainland in UAE. Emirates Chartered Accountants Group operates a separate wing for

VAT Services in Dubai, Abu Dhabi, Sharjah, Ajman, Fujairah & Ras Al Khaimah.

Our Tax experts coupled with industry experience from different parts of the world are present in the team to serve the clients in the best professional way providing services in the following areas:

- VAT Seminars, workshops, awareness programs & Training to the business owners, consultants and finance professionals.

- Advisory Services - Giving guidelines for companies on how to implement the new VAT law in their operation.

- VAT implementation Services - Our consultant will be engaged in the whole implementation procedure until the first VAT return is filed to the authority in 2018.

- Regular VAT return filing services.

Looking for TAX Services in the UAE?

We provide:

- Tax Agent’s Service

- VAT Return Filing

- VAT Service

- VAT Registration

- Excise Tax Service

- VAT Deregistration

For Tax Services in Dubai:

Mr. Pradeep Sai

sai@emiratesca.com

+971 – 556530001

For Tax Services in Abu Dhabi:

Mr. Vinay. E. R

vinay@emiratesca.com

+971 54 378 44140

For Tax Services in Northern Emirate (Sharjah, Ajman, RAK, Fujairah)

Mr. Praveen

praveen@emiratesca.com

+971 – 508873115