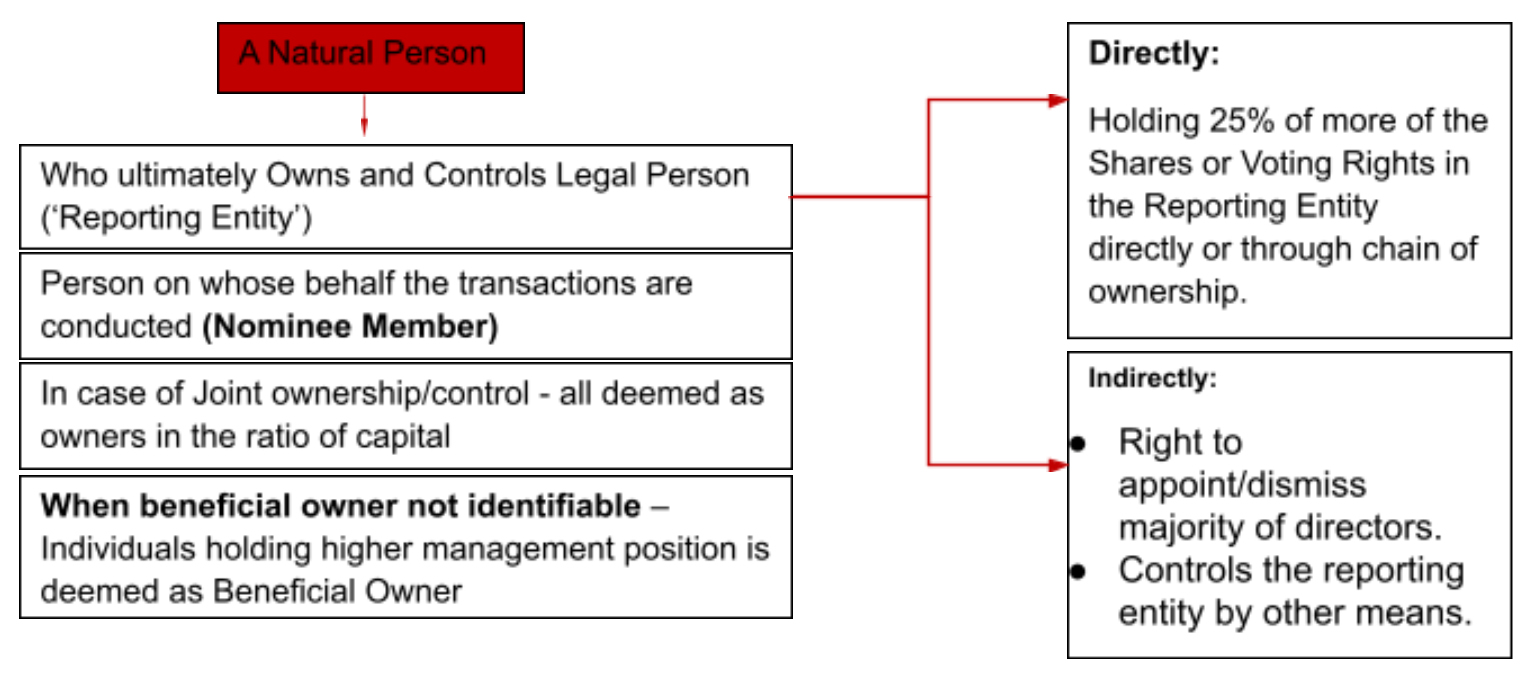

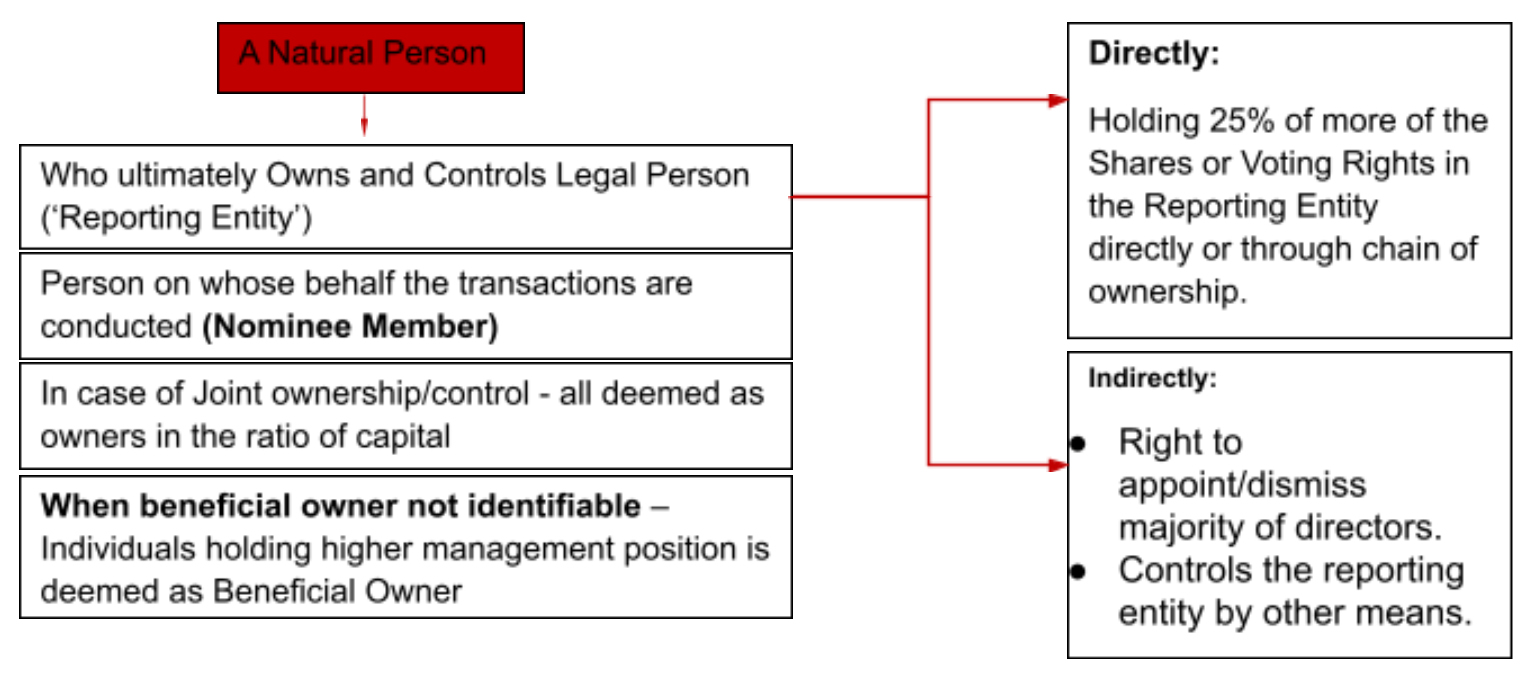

Who is an Ultimate Beneficial Owner?

What are the details required to maintain the Register of Beneficial Owners?

Though each licensing Authority has its own list of details, broadly, the Register of Beneficial Owner shall include the following data in respect of each Beneficial Owner:

- Full name

- Nationality

- Date & Place of Birth

- Passport / Identity card No., place of issuance, its issue date, and expiry date

- Residential Address or address where notice can be sent

- Email address and Phone number

- Number of shares held and its nominal value

- Date when a person became Beneficial Owner

- The date on which person ceased to become Beneficial Owner if any

What are the details required to maintain the Register of Shareholders or Partners?

The Regulation lists the details required to be maintained in respect of Shareholders of the reporting entity which are as under. However, each licensing has issued its own list of details and format to submit shareholders’ details.

| In respect of Individual Shareholders |

In respect of Corporate Shareholders |

- Full name (as passport or identity card)

- Nationality

- Address

- Place of Birth

- Name & Address of employer

- A true copy of a Valid Passport or ID

- Number of shares held by each holder with categories & associated voting rights

- Date when acquired capacity in Legal Person

- Details of any Shareholders or Partners acting as Trustee or Board Nominee Member, if any

|

- Name, legal form & MOA

- Head Office/ Principal Address (For Foreign Legal Person- Name & Address of legal representative in the UAE)

- Articles of Association or other similar documents

- Name of the person holding higher management position (their details on Passport/ ID No., Date of Issuance, Expiry, Issuing entity)

- Number of shares held with categories & associated voting rights

- Date when acquired such capacity in Legal Person

- Details of any Shareholders acting as Trustee or Board Nominee Member

|

How can we help??

Our professional, dedicated, and competent team shall assist you in:-

- Analyzing the corporate structure and Identification of UBO

- Compiling the information required to be submitted to the licensing authority in connection with UBO

- Undertaking the submissions with the licensing authority

- Ensuring compliance with all the formalities of the Regulation

- Ensuring that all queries and concerns on the Regulation is duly addressed.

Contact Now – Get UBO Compliant