Transfer Pricing Advisory Services UAE

Transfer Pricing

Emirates Chartered Accountants Group - Transfer Pricing Advisory Services in Dubai, UAE.

Call for Consultation

CA Manu Palerichal I CEO & Partner

Mob: +971 502828727

Email: manu@emiratesca.com

To whom UAE Transfer Pricing Regulations is applicable?

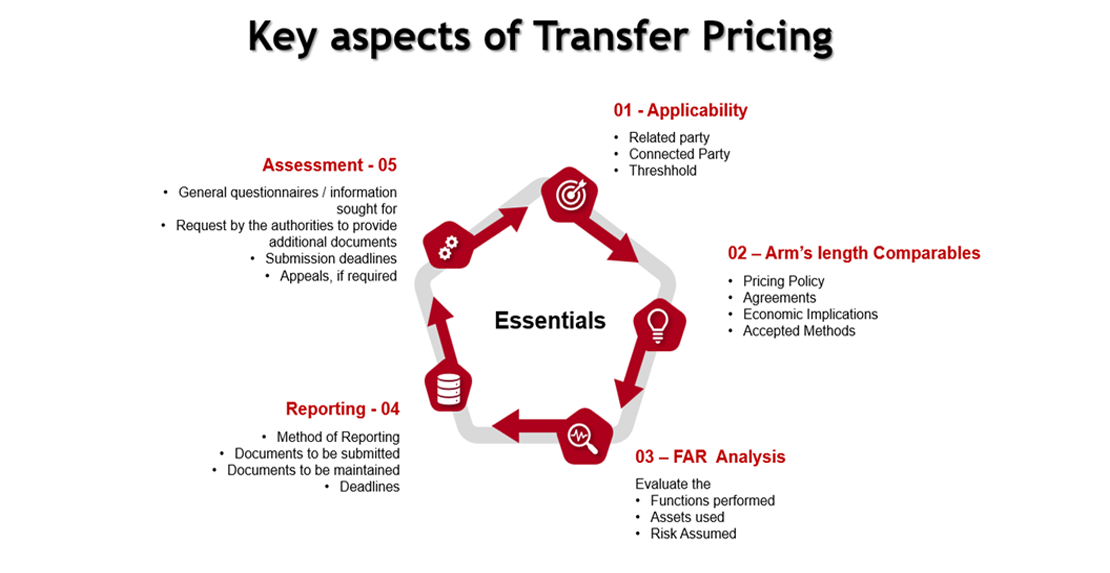

The proposed Corporate Tax Regime in the UAE vide release of Public Consultation Document inter-alia introduce Transfer Pricing rules to ensure that the price of a transaction is not influenced by the relationship between the parties involved.

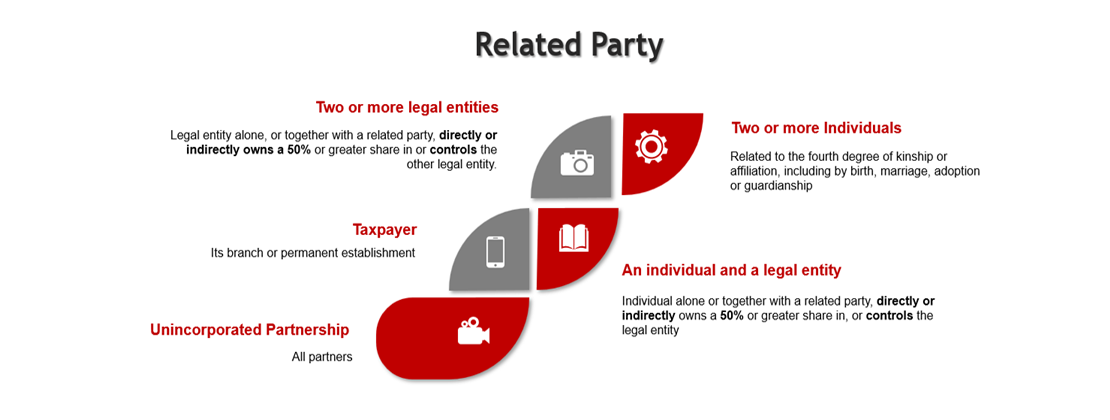

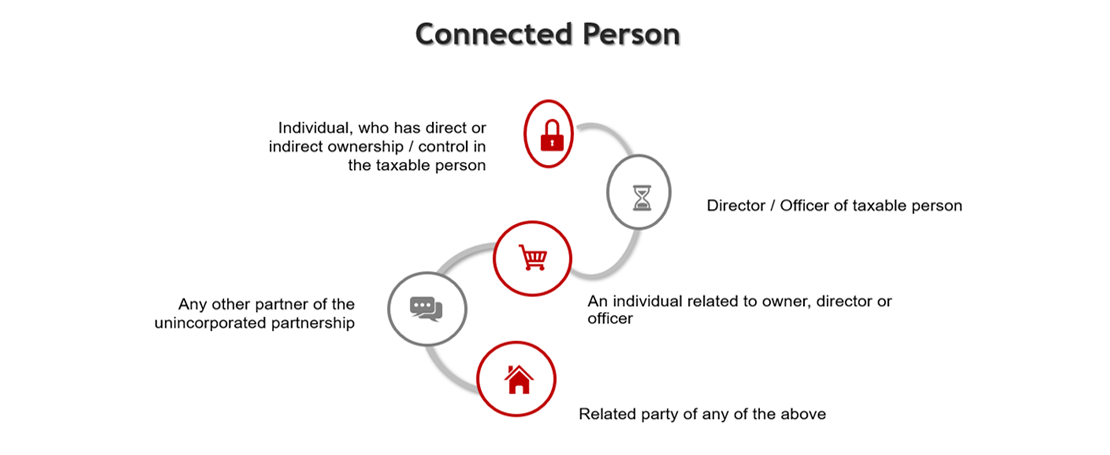

The Proposed CT regime requires ‘Arm’s Length’ principle to transactions between “Related Parties” and with “Connected Persons”.

How Can We Help You?

Our team brings vast experience to help you to manage your organization’s Transfer Pricing risk by delivering excellent Transfer Pricing assistance in a cost-conscious manner.

We are equipped to provide customized services in all the areas of Transfer Pricing, whether it is designing and planning your supply chain or ensuring accurate documentation to comply with Transfer Pricing Regulations in the UAE. Our experts shall be there to guide you on all the challenges faced while complying with these regulations.

High Impact Assessment:

- Understand the legal structure of the entity and the group at large

- Analysis of existing intergroup transactions

- Evaluating the applicability of Transfer Pricing Regulations

- Suggest a modification to existing Transfer Pricing policies in compliance with the proposed Corporate Tax law

- Assessing the impact of Transfer Pricing policies on their overall tax position

- Review whether any change

Advisory:

We can advise and assist you in all your queries regarding TP and ensure that the policies are robust and aligned to value creation or designing of new prices or the review of your current policies. We can also undertake the following assignments: -

- Help in developing and implementing efficient Transfer Pricing policies to optimize tax planning, considering the regulations of the Countries involved in the transaction.

- Assistance in determining the value of the transaction to arrive at arm’s length price Benchmarking Studies: - Conducting FAR analysis (including Functions, Assets, and Risks Analysis) - Performing economic analysis

- Implementation of Transfer Pricing policies

- Tax efficient restructuring of Supply Chain

- Carrying due diligence review to identify potential risks in adherence to Transfer Pricing regulation and documentation

- Creating tools and methodologies to keep track of the Transfer Pricing results.

- Conducting awareness session highlighting the aspects of Transfer Pricing

Documentation/Reporting:

Documentation is a crucial part of TP Regulations. They help in demonstrating that intercompany transactions are undertaken at an arm’s length price.

We provide you the following services to ensure you are compliant with all the regulations of Transfer Pricing in the UAE.

On Approval of the Audit plan, fieldwork is executed by performing a walk-through, inquiry, questionnaire, etc. Clients are kept informed of the audit process and the status of the audit.

Why ECAG for Transfer Pricing in the UAE?

Our team brings vast experience to help you to manage your organization’s Transfer Pricing risk by delivering excellent Transfer Pricing assistance in a cost-conscious manner.

Other Services We offer:

- Country by Country Reporting (CbCR)

- Transfer Pricing - Compliance (Local File & Master File)

- Transfer Pricing - Advisory