Excise/VAT Registration Service in Dubai, UAE

Excise/VAT Registration in the UAE

Emirates Chartered Accountants Group - Registered TAX Agent in the UAE with a professional VAT Registration Service in Dubai, UAE.

Call for Consultation

Mr. Hari Krishnan NPS

hari@emiratesca.com

+971 56 578 7047

Who should get Excise/VAT Registration in the UAE?

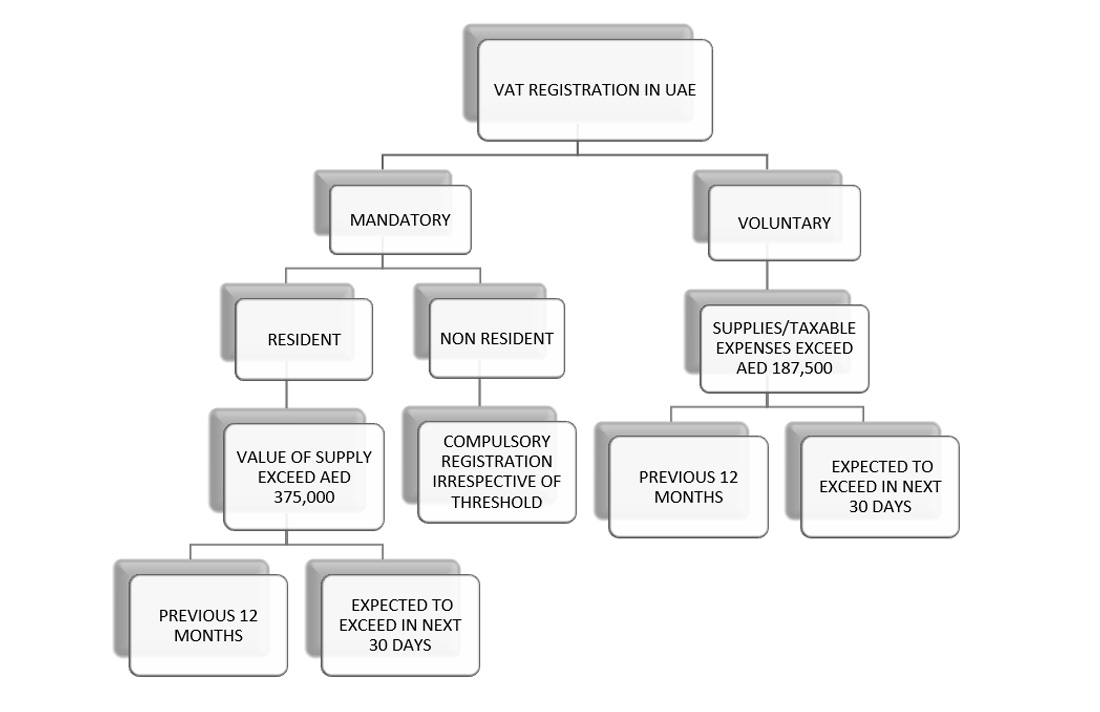

As per UAE VAT Law, there are two types of VAT registrations in the UAE. One is Mandatory VAT Registration & the other is Voluntary VAT Registration.

A. Mandatory VAT Registration:

- A person, natural or otherwise, who has made supplies/sales of more than AED 375,000 over the previous 12-month period shall mandatorily do his VAT registration in UAE.

- Any person, who does not have a place of residence in the UAE (Non-resident) shall mandatorily do VAT register in UAE if he makes any supply in the UAE irrespective of his turnover. This mandatory VAT registration is applicable to such nonresidents only if no one else is responsible for paying VAT on his behalf against such supplies.

Eg: Mr. Andrew, a UK Citizen, does not have a place of residence in the UAE. He performed services worth AED 100,000/ to the residents in the UAE who do not have VAT registration in UAE. In this case, even though the supply value is less than the mandatory VAT registration threshold, Mr. Andrew shall apply for VAT registration in the UAE. He will be responsible for collecting and liable to pay VAT to the authority. This rule applies to both natural and judicial persons. - Further, any person who estimates, on reasonable grounds that his supplies/sales will exceed AED 375,000 in the next 30 days shall also mandatorily apply for VAT registration in UAE.

B. Voluntary VAT Registration:

- A person can opt for VAT registration in UAE under the voluntary option if his supplies/sales for a previous 12-month period exceed AED 187,500/ (but less than AED 375,000/).

- In cases, a person who estimates, on reasonable grounds, that his supplies/sales will exceed AED 187,500 (but less than AED 375,000/) in the next 30 days may opt for VAT registration voluntarily.

- A person can opt for VAT registration in UAE under a voluntary option if his expenses which are subject to tax for a previous 12-month period exceed AED 187,500/.

- In cases, a person who estimates, on reasonable grounds, that his expenses which are subject to tax will exceed AED 187,500/ in the next 30 days also can opt of VAT registration under the Voluntary VAT registration method.

Exceptions for VAT registrations in UAE

Federal Tax Authority has clarified that a person can apply for an exception from VAT registration in UAE if 100% of his supplies/sales are Zero-rated as per the provisions of the Law. Such persons who want to opt for the exception from VAT registration shall notify the authority about their decision through the VAT registration form. Authority, if they feel such an exception is reasonable, will accept the application of the exception.

Concept of Tax Group

As per UAE VAT laws, any person conducting business in UAE is not allowed to have more than one VAT Registration number. Any person who has economic, financial or regulatory interests in multiple organizations may group their entities under one tax group.

Such grouping of businesses under one tax group eases the compliance requirements of the UAE VAT Laws. The tax group shall be considered as one single entity for the purposes of UAE VAT. Any transactions between the entities inside the tax group shall be out of the scope of UAE VAT.

Why Emirates Chartered Accountants Group?

Though it is perceived that the process of tax registration in the UAE is simpler when compared to many other tax regimes across the globe; it comes with its own set of hassles.

During the process of VAT registration, which is a seven-step procedure, various documents and details need to be filled in. Arranging the information accurately requires great knowledge and persistence. That is where our tax registration service comes in handy.

We are at the forefront of UAE VAT since its inception and have handled tens of thousands of clients successfully.

Our experts can guide you through the procedures and help you compile the necessary documents as sought by FTA.

Further, we have noted that FTA seeks explanations or clarifications on the details submitted which can be overwhelming for inexperienced minds. We will ensure that all the queries from FTA are answered within the stipulated time.

Emirates International Chartered Accountants

a registered Tax Agency Firm in the UAE

We, Emirates International Chartered Accountants are a registered tax agency firm in the UAE with tax agency number 30003933. The Tax Agent’s name is Mohamed

Mostafa Mohamed Ahmed Aly and holding TAAN 20022476 under FTA as an Approved Tax Agent in the UAE. Below is the screenshot from the official website of the Federal Tax Authority (FTA) showing our name as a registered tax agent in the UAE.

Emirates Chartered Accountants Group is the TAX Experts in UAE providing VAT Registration Service, VAT Consultancy Service, VAT Advisory Service, and Tax Agency Services in the UAE. For more information and for VAT registration services purposes, please contact our below representatives.

VAT Registration in Dubai

Mr. Arun

arun@emiratesca.com

+971-501934860

VAT Registration in Abu Dhabi

Mr. Hari Krishnan NPS

hari@emiratesca.com

+971 56 578 7047

VAT Registration in Northern Emirate

Mr. Praveen

praveen@emiratesca.com

+971 508873115