Latest Update on Tax Domicile Certificate or Tax Residency Certificate in the UAE

Tax Residency Certificate in UAE (‘TRC’) also known as Tax Domicile Certificate is an official document issued by the Government Authorities in any country on an application made by the resident (Individual or incorporated entity) to confirm that the applicant is a tax resident of its country.

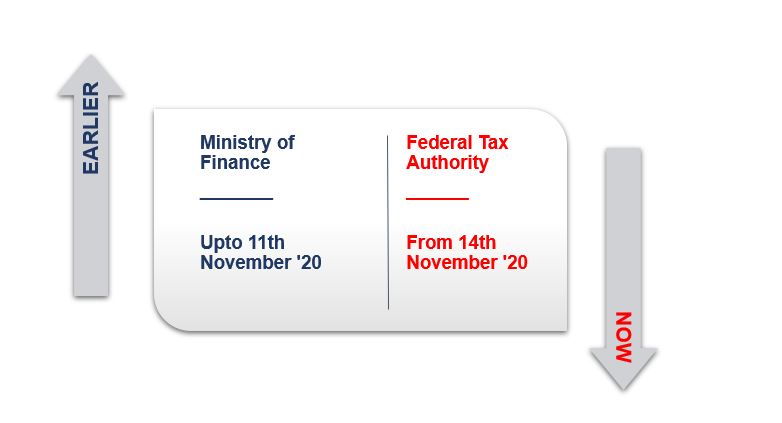

In the UAE Tax Residency Certificate or Tax Domicile Certificate was being issued by the Ministry of Finance (‘MoF’).

However, as per Cabinet Resolution No. (65) of 2020 issued on 5 November 2020, it has been announced that issuance of Tax Residency Certificate or Tax Domicile Certificate service is transferred from MoF to the Federal Tax Authority (‘FTA’)

Accordingly, MoF's website will stop receiving new applications from 11 November 2020. The submission link for the Tax Residency Certificate or Tax Domicile Certificate application service will be available on FTA's website with effect from 14 November 2020.

Therefore, from 14 November 2020, application for issuance of Tax Residency Certificate or Tax Domicile Certificate in the UAE will have to be made on FTA Portal.

Tax Residency Certificate or Tax Domicile Certificate has always been accepted as Ultimate proof to demonstrate that a person is a tax resident of a particular country. It is well-accepted fact that Tax Treaty provisions apply only to the Residents of the countries which are party to the Tax Treaty. Thus, to be eligible for the benefits of Tax Treaties existing between two countries, the primary requirement is to obtain the proof of residency, i.e. Tax Residency Certificate or Tax Domicile Certificate.

This also helps the nation to create a database of its residents and in case of need, helps in the exchange of information to render international cooperation.

Such a Tax Residency Certificate or Tax Domicile Certificate issued by the Tax Authorities is valid for a particular (single) tax year only.

Commercial Activities Certificate:

Along with the transfer of services regarding issuance of Tax Residency Certificate or Tax Domicile Certificates, MoF has also transferred the services of issuance of Certificate of Status of Business / Businessperson also known as Commercial Activities Certificate, to the FTA.

This document is issued for eligible government entities, companies and individuals to refund VAT paid in advance outside the UAE or that pertains to purchases in various countries, regardless of having an agreement of double taxation avoidance on income.

Methodology:

As per the press release issued by Emirates News Agency in connection with the Cabinet Resolution, it is clarified that users can make an application by via the online service portal of FTA. The user will be directed to enter his/her username and password. On successful registration on the service portal, the user will be directed to the list of all requests related to tax certificates assigned to him/her, appearing in the control panel.

The registrant has the opportunity to choose to submit one or several requests, and once selected his/her desired option, all the details of the request will appear and will be provided with the choice to approve, complete, reject or refund any taxes paid outside the UAE which allows for a tax refund.

The registrant will be able to download the attachments to verify the data, complete the process and follow-up the status of their request.

Documents:

The Cabinet Resolution No. (65) of 2020 transfers the Authority to issue Tax Residency Certificate or Tax Domicile Certificate and Commercial Activities Certificate to FTA and specifies the Fee in regard to the issuance of such Certificates. It can therefore be inferred that the eligibility to make the application (residing for at least 183 days in case of individual / Operation in the country for at least one year in case of Company), the documents and details required to be submitted to obtain the Tax Residency Certificate or Tax Domicile Certificate would primarily remain the same as it is currently.

To obtain Tax Residency Certificate or Tax Domicile Certificate the documents required are as under:

Documents Required - For Individuals:

- A copy of Passport and Emirates ID

- Valid residence permit

- A certified copy of the (residential) lease agreement / Tenancy contract

- Bank statement for last six months

- Salary certificate / Income certificate

- A report from the General Directorate of Residency and Foreigners Affairs mentioning the duration of the person’s stay in UAE (Minimum 183 days)

- Tax forms (if any) from the country where the certificate needs to be submitted

Documents Required - For Companies:

- A copy of valid trade license

- A copy of Articles of Association and Memorandum of Association

- A copy of the company’s owners/partners/directors’ passports, IDs and permits of residence.

- Certified Audit Report

- Bank statement for at least six months

- A certified copy of the lease agreement (ejari).

Fees for the issue of Tax Residency Certificates by FTA:

The Authorities have revised, rather reduced the fees for making an application for and issuance of Tax Residency Certificate or Tax Domicile Certificates. The revised fees for the services in connection with the issuance of Certificates are under:

| Sr. No. | Service Description | Fee (in AED) |

Fee (in AED) |

| Before | Post 14 November 2020 | ||

| 1 | Submission of application for a Tax Residency Certificate | 100 +3 per Application | 50 per Application |

| 2 |

Review of Tax Residency Certificate application and issuance of an electronic certificate to a registrant with the Authority |

10,000 or 2,000 depending on the Status | 500 per Application |

| 3 |

Review of Tax Residency Certificate application and issuance of an electronic certificate to a legal person not registered with the Authority |

10,000 + 3 Per Application |

1,750 per Application |

| 4 |

Review of Tax Residency Certificate application and issuance of an electronic certificate to a natural person not registered with the Authority |

2000 + 3 per Application | 1,000 per Application |

| 5 | Printed paper copy of the issued electronic Tax Residency Certificate | N.A. | 250 per Certificate |

Income-tax in GCC

The trend shows that The GCC countries are tilting towards the introduction of taxes as an avenue to generate revenue. This is evident by the announcement made by the Sultanate of Oman to introduce taxes on rich individuals by 2022. Also, as per the news reports, Bahrain and Kuwait are considering introducing income-tax in near future.

In this era of globalization where businesses are no longer restricted to a single geographical territory, it is of utmost importance that every individual and business ensures that it is not paying taxes twice and that it has optimised its tax cost. Further, considering the strong economic and social connection between residents of different GCC countries, it will be essential for the Residents of GCC countries to identify and substantiate their actual country of residence and therefore the Tax Residency / Domicile Certificate would play a vital role in determining their taxability.

Frequently Asked Questions:

1. I am residing in the UAE and as such, I am not liable to pay tax in the UAE. But I am paying Tax in my home country. How Tax Residency Certificate will help me for my Tax liability?

As a resident of UAE and with the Proof of being Resident i.e. by obtaining Tax Residency Certificate, you will be eligible to take advantage of the provisions of the Tax Treaty between UAE and your home country.

The Tax Treaty has a tie-breaker rule to determine the Residency of an individual i.e. in which country will the individual be considered a resident of. Tax treaty also helps ascertain whether a particular income would be taxable in the source country or the country of residence. Tax Residency Certificate helps to ensure that the tax position taken is correct and the tax liability determined is optimal.

Further, one can also avail the advantage of lower tax withholding, if any, specified in the Tax Treaty.

2. I am residing in the UAE under my husband’s sponsorship visa. Am I eligible for the Tax Residency Certificate?

Any Individual residing in the UAE for more than 183 days would be eligible to make an application for obtaining a Tax Residency Certificate / Tax Domicile Certificate. However, as per the dashboard on the FTA website, it appears that the Tax Residency Certificate application should be done by individuals residing and working in the UAE. Therefore, without having source income in the UAE, it may be difficult to complete the application to obtain a Tax Residency Certificate.

However, if such individual requires the Tax Residency Certificate, to take benefit of the Tax Treaty, it is advised that the case be put forth before the FTA by e-mail or by attaching the detailed explanation in the application (source of Income column). And it is expected that FTA would consider the application based on facts of the case.

3. How much time normally does it take for a company to get a Tax Residency Certificate?

Eligible Company will have to make an application on the FTA portal which will be reviewed by the FTA and then approved. To receive the Certificate, it generally takes about 3 working days from the date of approval of application and payment of fees.

4. My company is registered for VAT in the UAE. Can we claim a VAT refund by applying a Tax Residency Certificate?

Tax Residency Certificate or Tax Domicile Certificate is proof to demonstrate that a person is a Tax Resident of a particular country. It is supporting to claim the benefits of the Double Tax Avoidance Agreement and to avoid dual taxation of a particular income and nothing to do with a VAT refund.

To claim a refund for VAT paid in advance outside the UAE, eligible government entities, companies and individuals will have to make an application for Certificate of Status of Business also known as Commercial Activities Certificate.

After submitting the VAT periodic return, if you are in a refundable position, you can apply for a refund of the VAT by submitting the VAT Refund Form 311.

Our Services:

Our experienced and qualified professionals can support and guide you in the verification of the documentation required and obtaining the Tax Residency Certificate or Tax Domicile Certificate without any hassle.

Tax Residency Certificate or Tax Domicile Certificate in the UAE

Viju Divakaran

Manager – Company Incorporation

M:+971554028899

E:viju@emiratesca.com