Tax Agent Services in Dubai, UAE

Tax Agent Services UAE

Emirates Chartered Accountants Group - Federal Tax Authority (FTA) Registered Tax Agent in Dubai, UAE.

Call for Consultation

Pradeep Sai | Partner

Mob: +971 556530001

Email: sai@emiratesca.com

Role of a Tax Agent in the UAE

- Help save time and money

- Assist Tax Implementation & Registration

- Assists in Timely Return Filing

- Acts as a long-term advisor

- Assist in Tax Assessment & Representation

A Tax Agent in UAE, registered with the authority is expected to

- Support his clientele with Tax return filing assistance, ensuring timely submission of the tax return.

- Support in submitting the refund application and assist in answering queries from the Federal Tax Authority (FTA) related to the same.

- It is the responsibility of a tax agent in UAE, upon auditor’s request, to furnish all relevant documents required on the course of a tax audit in the UAE

- Tax agent must ensure that he maintains confidentiality about the client’s information while retaining the concerned records for a period of 5 years (15 for Real Estate Companies)

- It is expected that, as a registered tax agent in UAE, he/she shall maintain a record of their ‘Continuing Professional Development’ on a yearly basis.

Why Emirates Chartered Accountants Group?

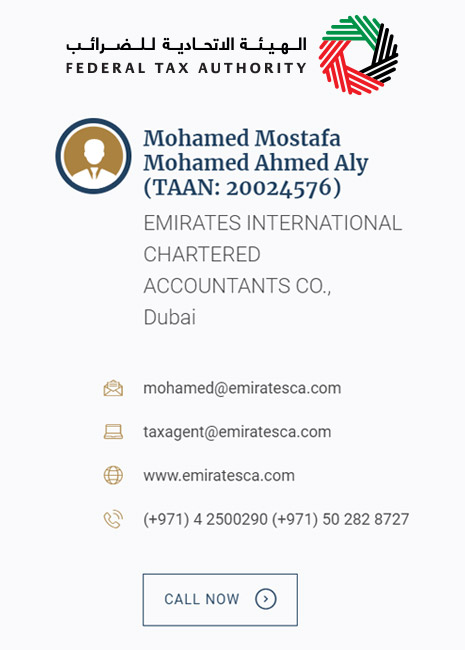

We, Emirates International Chartered Accountants are a registered tax agency firm in the UAE with tax agency number 30003933. The Tax Agent’s name is Mohamed Mostafa Mohamed Ahmed Aly and holding TAAN 20024576 under FTA as an Approved Tax Agent in the UAE. Below is the screenshot from the official website of the Federal Tax Authority (FTA) showing our name as a registered tax agent in the UAE.

As your Tax Agent in the UAE, it will be our duty to support you in tax compliance while maintaining strict confidentiality about the transactions involved.

Being a leading professional/Audit firm in the region, we are committed to upholding the professional standards expected from us. Our confidence is rooted in 2000+ happy clients whom we have supported in developing accurate tax systems.

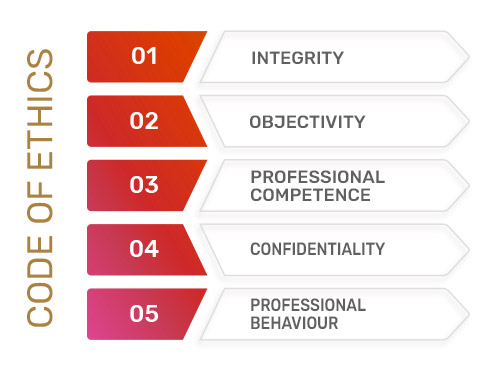

As Registered Tax agents in UAE, we are bound to adhere to a certain code of ethics to ensure ethical conduct as expected from a professional body. It is due to such strict adherence to policies and plans, we enjoy the goodwill of what we are today.

Appointing a Tax Agent in UAE

A taxable person can appoint a tax agency firm through their e-services portal on the FTA website.

If you wish to appoint Emirates International Chartered Accountants Co. as your tax agency, you should access your e-services portal. You shall use the ‘ Appoint tax agency’ link in the Dashboard. Search for ‘taxagent@emiratesca.com’ in the tab and all our details will appear. Click on ‘Submit a request’ which alerts us about your interest.

Once we receive your application, we will contact you and enter in to contract as required by the law. Our tax agent in UAE will be assigned to you immediately after finalizing the contract and can render tax agent services as sought.

We Emirates International Chartered Accountants provide Tax Agent Services, Tax Advisory Services, VAT Implementation Services, VAT Return Filing, VAT Compliance Review, and Tax Consultancy Services in all Seven Emirates – For more information on tax agent services, please contact our following representatives:

For Tax Agent Service in Abu Dhabi

Mr. Hari Krishnan NPS

hari@emiratesca.com

+971 56 578 7047

For Tax Agent Service in Dubai & Northern Emirates

Mr. Manu Palerichal

manu@emiratesca.com

+971 50 2828727