How to do the online VAT registration in the UAE?

&What is the online portal/website for VAT registration?

You can access the Federal Tax Authority’s online portal and start the registration process. Below we explained the entire process to do the registration in online.

How to create an account in the UAE VAT Online Portal?

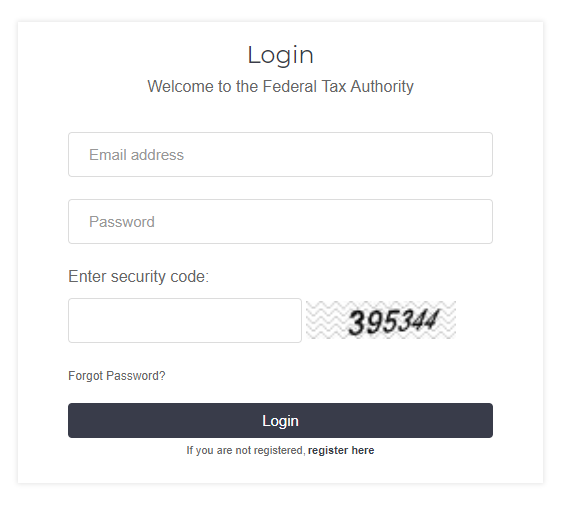

Once you click the link, you will reach a page as shown below.

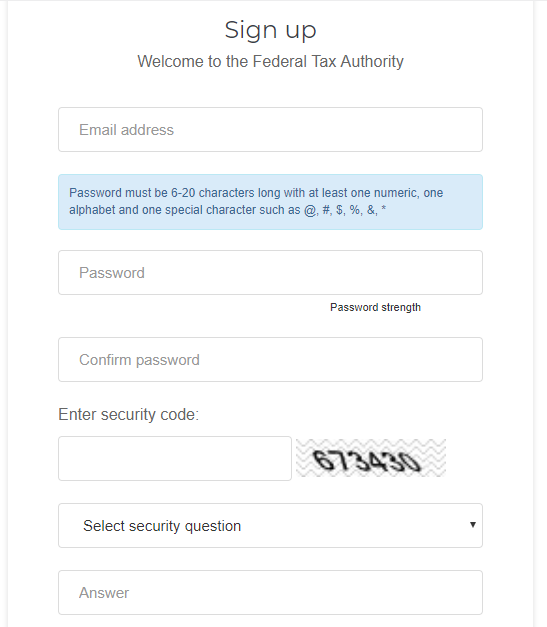

Being the first time user, before login, you have to register. Hence go to the last part of the above slide and click for register. Once you click register here, you will be reached to a page to create an account, as shown below.

Once you register, to verify your account, an email will be sent to your registered e-mail address with a link. You can click this link and activate your account.

How to proceed with VAT Online Registration?

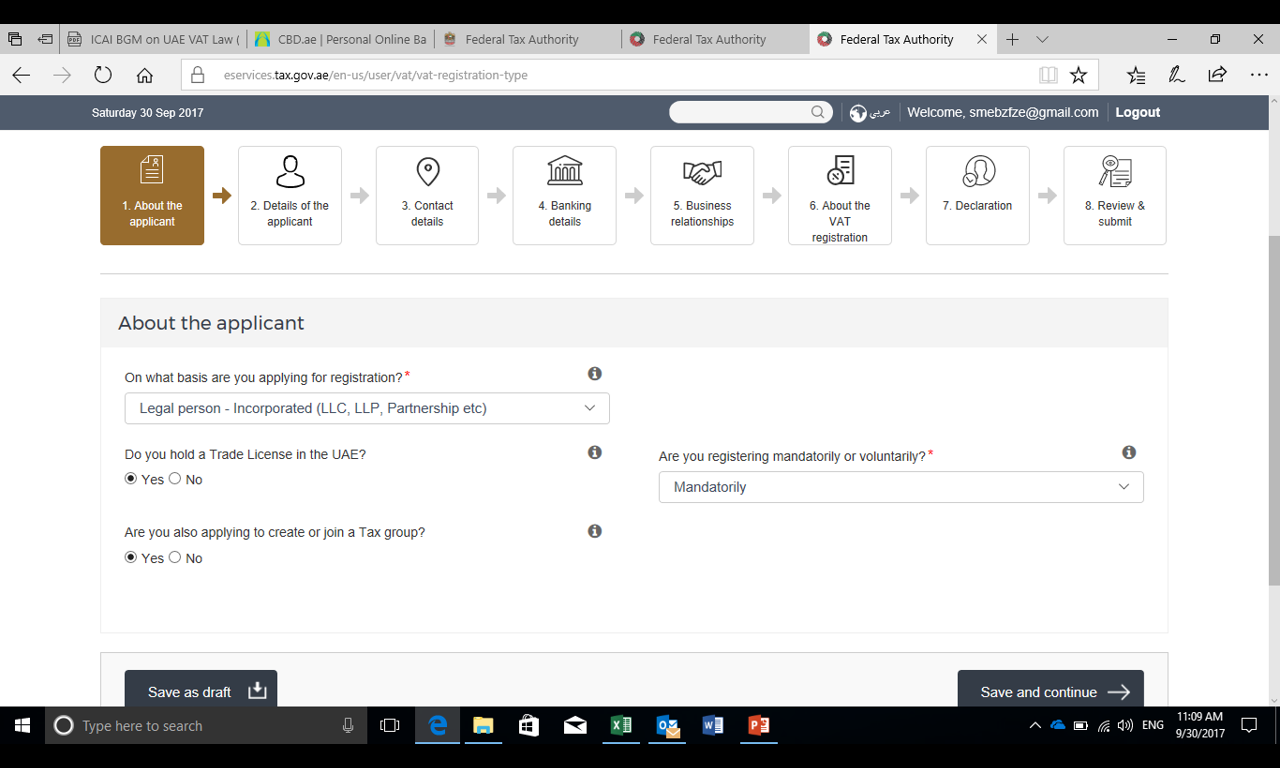

Once you activate your account, you can reach to the VAT online portal as shown below.

As the first step, you should decide, whether you are registering your company or yourself as a natural person. If you have more than one company in operation, analyze whether to register the companies separately or as a Tax Group?

What are the documents to be kept ready before you proceed for registration?

- Trade license copy

- Memorandum of Association of the company

- Articles of Association of the company

- Passport copy of the manager/authorized signatory

- Emirates ID copy of the manager/authorized signatory

- Power of attorney copy (if any)

- Financial Statement/Audit Report/Sales Calculation Sheet

- Certificate of Incorporation (wherever applicable)

- Customs Authority registration Certificate (if applicable)

What are the other Informations required for VAT online registration?

- Business activities of the companies

- Previous 12 months turnover figures

- Projected Sales

- Expected values of imports and exports

- Whether you expect to deal with GCC suppliers

- Whether you expect to deal with GCC customers

- Bank account details etc.

Who can opt for Group Registration?

In the UAE, many companies both corporates as well as SMEs operate with multiple licenses and work as one group. The companies might be registered in different emirates under different authorities, but operate together as a group. In such cases, they can look for registering together as a Tax Group. Following conditions are to be satisfied to opt for registering as a Tax Group.

- All companies should have their main office with the license (place of establishment) or a branch office or representative office (called fixed establishment) in the UAE.

- They should be related parties.

- Either one controls others, or two or more persons together control the others.

In a practical scenario, even though one is not a shareholder in all companies but is controlling the companies by his power of attorney, it can be considered as a related party for the purpose of a VAT group and can choose Tax Group option. Further while registering as a Tax Group, we should provide evidence of the group structure showing the controlling or shareholding structure as well as a board resolution from each member companies resolving that they have appointed a company as the representative of the group for VAT purpose.

What are the important points we have to consider while giving the bank account details?

If you are registering your company as a standalone, you can give any one of the UAE bank accounts. You have to provide the name of the bank, branch name, account name and IBAN code. You should give the bank account of the company for which you are registering, and not of any other related party bank account. If you are registering for VAT under TAX group option, you can give only one bank account number; not of all companies of the group. This bank account will be of the representative company which you choose while registering for VAT as Tax Group.

Can we submit the VAT online registration in English also or Arabic is mandatory?

You can submit the application in English as well. However, there are 3 columns where we have to submit the information in Arabic as well.

- Name of the company

- Name of the manager

- Name of the authorized signatory

How to calculate turnover for VAT registration purpose?

The threshold for registration will be:

- Mandatory registration threshold: AED 375,000

- Voluntary registration threshold: AED 187,500

Following sales are to be considered for arriving the threshold.

- Standard rated supplies

- Zero-rated supplies

- Reverse charged services received &

- Imported Goods.

However, exempted supplies should not be considered for the above calculation.

What supports Emirates Chartered Accountants group can give you for Online VAT Registration?

We Emirates Chartered Accounts Group has an exclusive division called Indirect Tax Division to handle all types of indirect tax services in all emirates of UAE; Dubai, Abu Dhabi, Sharjah, Ajman, Um Al Quwain, Ras al Khaimah and Fujairah. More than 30 members are working under the VAT section and there is a special wing for VAT registration services. We support the clients by guiding for Online VAT registration.

Our team do the registration services also for your company. In order to avail our services, you may please contact the below representatives. Our team will collect all required documents and information for registering your company for VAT. You may provide those details by email. We need the documents only in soft copy since the registration has to be done through the online portal.

Once we receive all documents and information necessary for registration and get approval from you to proceed, we will register in the online portal of VAT with your email ID. Once we complete the form and check by our self it will be forwarded to you to have a review for the final approval. Only after getting your approval, we will be submitting the form to the FTA.

The FTA will then process the application and will respond to confirm your Tax Registration Number. Further, the VAT Division is also into VAT Implementation services, VAT advisory services, VAT return filing services etc. Please feel free to contact our below representatives for VAT REGISTRATION

Looking for TAX Services in the UAE?

We provide:

- Tax Agent’s Service

- VAT Return Filing

- VAT Service

- VAT Registration

- Excise Tax Service

- VAT Deregistration

For Tax Services in Dubai:

Mr. Pradeep Sai

sai@emiratesca.com

+971 – 556530001

For Tax Services in Abu Dhabi:

Mr. Vinay. E. R

vinay@emiratesca.com

+971 54 378 44140

For Tax Services in Northern Emirate (Sharjah, Ajman, RAK, Fujairah)

Mr. Praveen

praveen@emiratesca.com

+971 – 508873115