- Jun 28,2024

- All | Corporate Tax in UAE

Navigating UAE Corporate Tax Registration: Key Deadlines and Guidelines

Introduction

Navigating the corporate tax landscape in the UAE can be a complex endeavour, but understanding key deadlines and guidelines is essential for ensuring compliance. The UAE Federal Tax Authority (FTA) has recently issued a public clarification on the UAE Corporate Tax Registration deadline for 2024. This article will guide you through the important aspects of corporate tax registration, ensuring your business stays on the right track.

Background - UAE Corporate Tax

The Corporate Tax Law in the UAE came into effect on June 1, 2023, marking a significant shift in the country's taxation framework. This law mandates the registration of businesses for corporate tax, a process that will be critical throughout 2024. The FTA's Decision No. 3 of 2024, issued on February 22, 2024, and effective from March 1, 2024, outlines the timeline for registration.

Understanding Corporate Tax in the UAE

Corporate tax in the UAE applies to various entities, including companies incorporated within the UAE and those operating outside the country but generating income within its borders. This tax aims to standardize and streamline tax processes, ensuring fairness and transparency in the business environment.

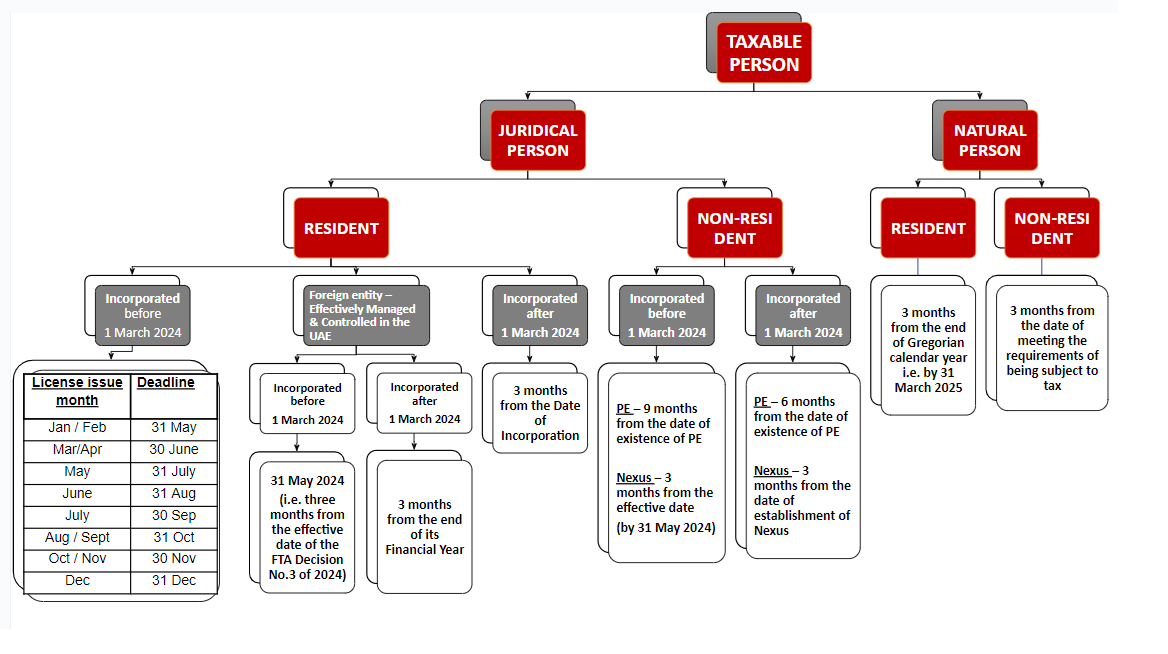

Key Deadlines for Corporate Tax Registration

According to Decision No. 3 of 2024, the timeline for registering with the FTA is clearly defined. Businesses must adhere to these deadlines to avoid penalties and ensure compliance. The effective date for this decision is March 1, 2024, which sets the stage for a busy registration season.

Clarification on Registration Deadlines

On June 4, 2024, the FTA issued a guide to clarify the registration deadlines for different types of taxable persons. This guide provides detailed timelines tailored to the nature of each business, ensuring that all entities have clear instructions on when to register.

Steps to Register Your Company for Corporate Tax

Using the Emara Tax Portal

The Emara Tax portal is the UAE's primary platform for corporate tax registration. If your company is already registered for VAT, you can use your existing login credentials to access the portal and proceed with registration. This streamlined process helps simplify the registration for those familiar with the VAT system.

Special Cases

Companies with licenses that expired on March 1, 2024, but were not cancelled, must submit a tax registration application based on the month of the original license issuance. For businesses holding multiple licenses, the earliest issuance month should be used to determine the registration deadline.

Detailed Registration Process

Required Documents To complete the registration, you will need to prepare specific documents, including:

- Trade license

- Proof of business activity

- Identification documents for owners and managers

Step-by-Step Guide

- Login to Emara Tax Portal: Use your VAT credentials or create a new account.

- Fill in Required Information: Provide business details, contact information, and upload necessary documents.

- Submit Application: Review your information and submit the application.

- Receive Confirmation: You will receive a confirmation email once your registration is processed.

UAE Corporate Tax Registration Critical Deadlines

The following are critical deadlines for corporate tax registration:

- No License as of March 1, 2024: Register by May 31, 2024

- Offshore Companies: Register based on the incorporation date

- Foreign Entities Managed and Controlled in the UAE Prior to March 1, 2024: Register by May 31, 2024

- Non-Resident Juridical Person Recognized as a Permanent Establishment (PE): Register within nine months from the existence of the PE. The PE is deemed to exist once the place of business has established a degree of permanence of six months in the UAE, assuming all other requirements for a PE are met. Provisions of DTAA to be considered in case it provides longer duration to recognize PE.

- Nexus: Created only when the Juridical Person starts earning income from the property purchased in the UAE

- Natural Person (Individuals Carrying Out Business Activity): Should register if the consolidated revenue of all their businesses exceeds AED 1 million during the Gregorian calendar year

Illustrative Examples

Example 1

Company Y, a UK company established on June 1, 2024, with strategic decisions made in the UAE, making it a Resident Person. Financial Year is June to May. Must register for Corporate Tax by August 31, 2025, i.e., within three months after the end of its next financial year.

Example 2

Company Q, was incorporated in the USA on September 30, 2008, and opened a branch in the UAE on May 1, 2023. The UAE branch meets the criteria for a Permanent Establishment (PE) as of December 1, 2023. As a Non-Resident Person with a PE before March 1, 2024, Company Q must register by September 1, 2024, i.e., within nine months from the existence of the PE.

Even if the PE was attained on May 1, 2023, the Permanent Establishment shall be deemed to have started on June 1, 2023. A six-month duration should be taken into account before the date of existence of PE. This means PE's date of existence will be December 1, 2023.

Consequences of Late Corporate Tax Registrations

As each deadline approaches, the FTA urges businesses to file the Corporate Tax Registration to avoid any penalties due to delays. Failing to register would lead to a penalty obligation of AED 10,000.

For the proper administration of the Corporate Tax Registration for your business or Corporate Tax Impact Assessment for first-time adoption, you can contact tax@emiratesca.com. Stay updated with the latest tax regulations to ensure your business meets all compliance requirements.

Non-resident entities, especially those with Permanent Establishment or nexus in the UAE, must assess their tax obligations promptly. Understanding the implications of these regulations and acting swiftly can help mitigate risks and ensure smooth operation in the UAE business scenario.

Conclusion

Registering for corporate tax in the UAE is a crucial step for businesses operating in the region. By understanding the key deadlines and guidelines, you can ensure your business remains compliant and avoids potential penalties. Stay informed, prepare thoroughly, and utilize available resources to navigate this process successfully.

FAQs on deadline for corporate tax registration in the UAE

Q1: When is the deadline for corporate tax registration in the UAE?

A1: The deadline varies based on the type of business and the issuance date of licenses. Refer to the FTA guidelines for specific timelines.

Q2: Can I use my VAT credentials for corporate tax registration?

A2: Yes, VAT-registered companies can use their existing login credentials for the Emara Tax portal.

Q3: What happens if I miss the registration deadline?

A3: Missing the deadline can result in penalties, including fines and potential legal action.

Q4: Do I need to register if my license expired but was not cancelled?

A4: Yes, you must submit a tax registration application based on the original issuance month of your license.

Q5: Where can I find more information and support?

A5: The FTA website provides comprehensive resources and support channels for businesses.