Taxable Persons

As per Chapter 4 Article 11 of Federal Decree-Law No.47 of 2022 Taxable persons shall be either a Resident Person or a Non-Resident Person including a natural person and Branch of a taxable person which is considered the same as a Taxable Person.

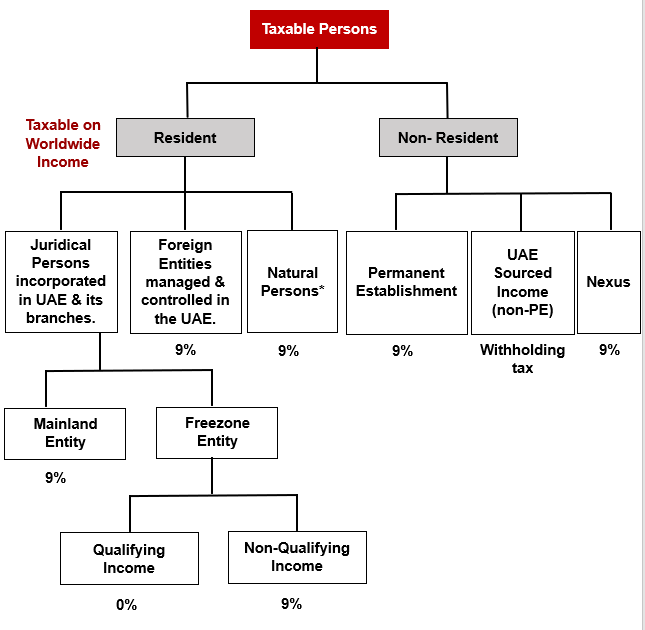

The taxable persons and corporate tax base under the UAE Corporate(hereafter referred to as CT) Tax regime is summarized hereunder:

*Natural Persons Taxable on income derived from outside UAE only if it relates to the business activity conducted in UAE.

Taxability of Natural Person

As per Cabinet Decision no 49, it has been made clear that there is no intention to parallelly tax the income of the natural person. Therefore Wage, Personal Investment income, Real Estate Investment income, employment income, and other personal income earned by UAE residents and foreign individuals will not be within the scope of the proposed UAE Corporate tax regime.

The natural person who is not conducting a Business or Business Activities subject to Corporate Tax under this Article shall not be required to register for Corporate Tax.

The treatment of income earned by Natural Persons (Individuals) within a Gregorian calendar year under the UAE Corporate Tax regime is summarized hereunder:

| Salary and other employment income (whether received from the public or private sector) | CT Not Applicable |

A resident natural person’s income derived from business activity in the UAE or outside the UAE | CT Applicable if total Turnover derived from such Businesses or Business Activities exceeds AED 1,000,000/- |

| The investment in real estate and rental receipts from such investment by individuals in their personal capacity | CT Not Applicable provided the individual is not required to obtain a license or permit to do the activity nor considered as a commercial business in accordance with the Federal Decree-Law No. 50 of 2022. |

| Other Investment Income (investment held in a personal capacity) | CT Not applicable |

| Dividends, capital gains, and other income earned from owning shares or other securities in their personal capacity | CT Not Applicable |

| Interest and other income earned by an individual from bank deposits or saving schemes | CT Not Applicable |

| Income earned by Individual from activities carried out under a freelance license / permit OR from an activity which requires a license/permit to perform such activity as per local laws | CT Applicable total income derived from such activities exceeds AED 1,000,000/- |

Taxability of Legal Persons

| Type of legal entity | Taxability |

| Legal Person (Limited Liability Companies, Private Shareholding Companies, Public Joint Stock companies, and other entities that have separate legal entities) incorporated in the UAE | CT Applicable |

| Legal Person incorporated in a foreign jurisdiction, but effectively managed and controlled in the UAE | CT Applicable, as if UAE incorporated |

| Limited liability partnership/partners limited by shares (where no partner has unlimited liability) | Treated as UAE Entities - CT Applicable (Entity will be subject to tax and not the partners) |

| Limited and general partnership / other unincorporated joint ventures and AOP |

|

| Collective Investment funds that are structured as limited partnerships | Treated as transparent entities – partners/members taxable |

| Foreign unincorporated partnerships | To follow the tax treatment of the respective foreign jurisdiction |

Our comments:

The concept of Place of Effective Management (‘POEM’) triggers tax implications when the residents of the UAE conduct business by establishing legal entities outside the UAE. In this scenario, there is a possibility that these legal entity(ies) (which are managed and controlled in the UAE) established outside the UAE may be taxable in both jurisdictions and will have to determine the taxability based on the tie-breaker Rule of the Double Taxation Avoidance Agreement between the two jurisdictions.

It is therefore recommended that businesses established outside the UAE but managed and controlled from the UAE may analyse the tax implications to optimise tax expenses.