- Sep 23,2022

- All | International Taxation

Intra-group Services Under Transfer Pricing

With the introduction of the Corporate Tax Regime in the UAE (effective from June 2023), Transfer Pricing Regulation will also be introduced. It has been conveyed through the Public Consultation Document that the UAE shall adopt the Transfer Pricing guidelines issued by the Organisation for Economic Cooperation and Development (“the OECD”). In this article, we will discuss the most common but most complicated Transaction that occurs (knowingly or unknowingly) between the group entities viz. Intra-group services.

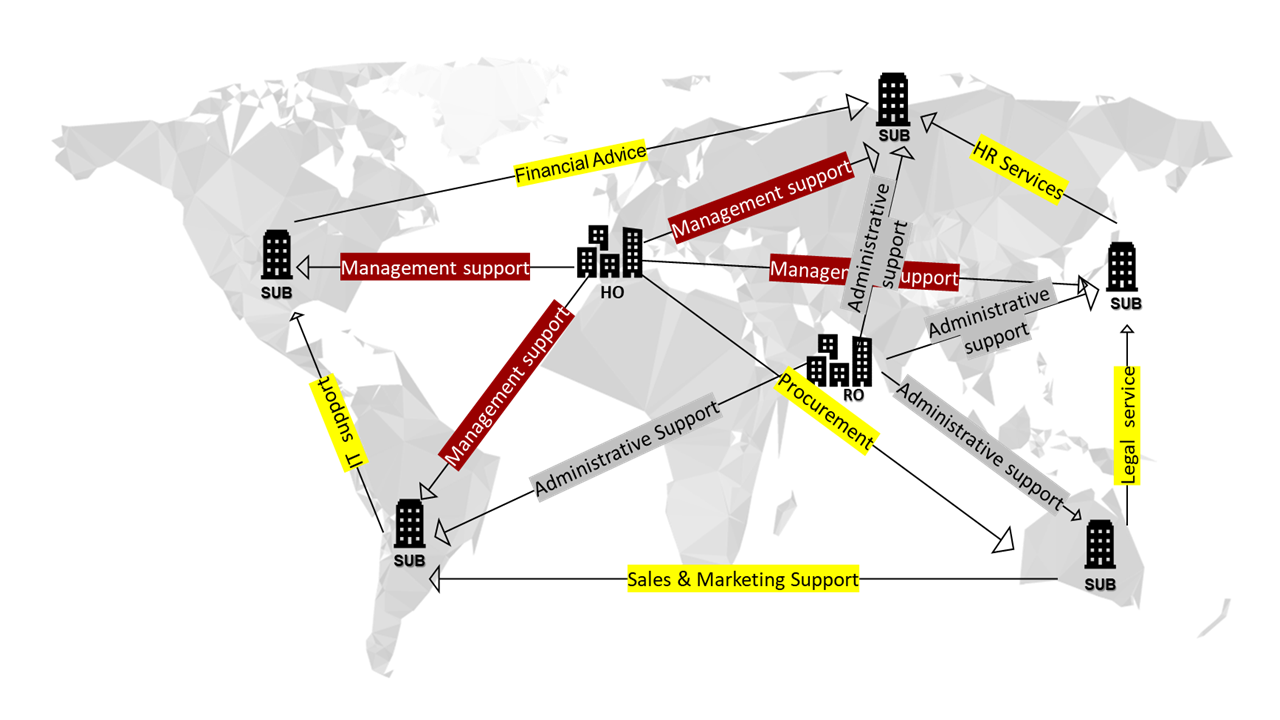

In the present era of globalization, diversification, and expansion, most entities depend on other entities of the same group to avail specialized services, which leads to a large web of transactions between related parties / associated entities.

Intra-group Services are the most used area for tax planning; therefore, they catch the attention of Tax Authorities across the globe.

Further, the nature of intra-group services is such that it leaves one puzzled as to whether a markup is required to be charged on such services or not. Also, some services are of very low value that one may be required to analyze whether a detailed benchmarking analysis is required or there can be some simplified approach to benchmark and arrive at arm’s length price.

Intra – group Services - Transfer Pricing Guidelines

The OECD Transfer Pricing Guidelines for Multinational Enterprises and Tax Administrations”, the latest released in January 2022. (henceforth referred to as ‘the OECD Guidelines) gives detailed guidance on issues that arise in determining Transfer Pricing for Intra-group services.

The OECD Guidelines discuss two main aspects: -

- Whether intra-group services have in fact been rendered?

- What should be the intra-group charge for such services for tax purposes – application of the arm’s length principle?

Determination of whether intra-group services have in fact been rendered?

The services provided by the MNE group are not always subject to a charge for the recipient. If services are not remunerated or no benefit is derived by the recipient, they are not considered Intra-group services, and Transfer Pricing Regulations may not be applicable.

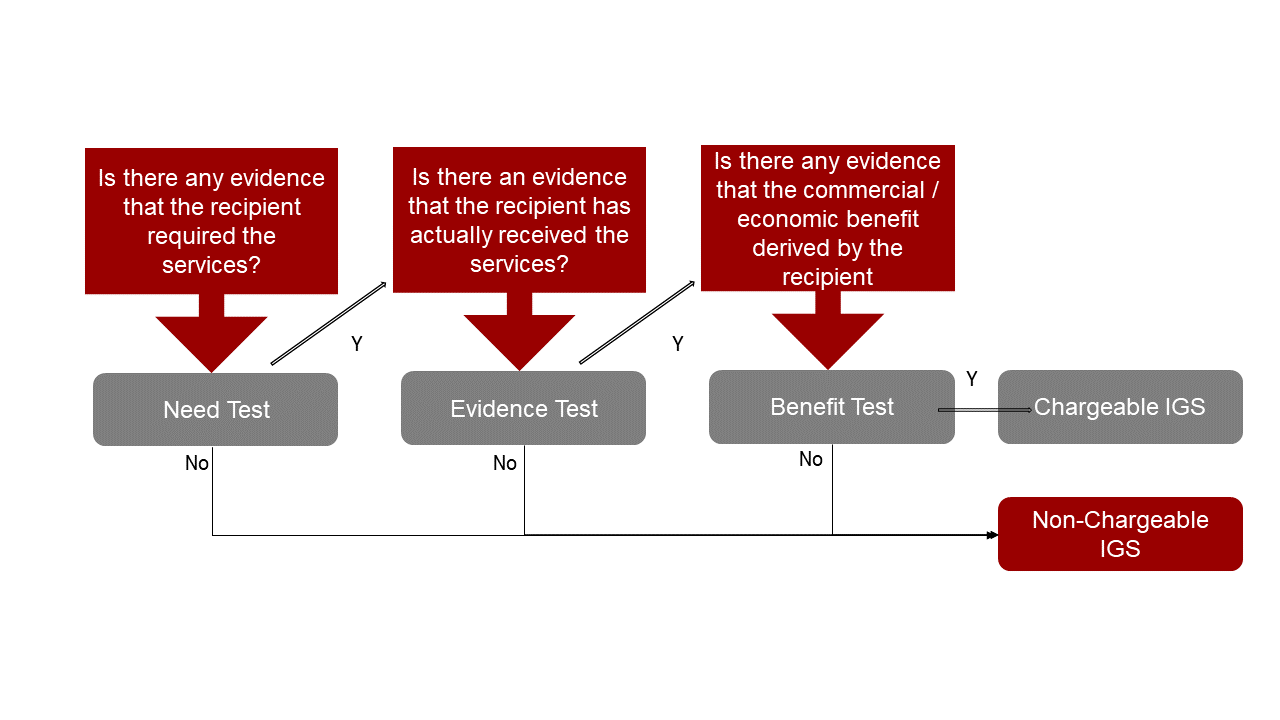

Therefore it is essential to first determine whether the services are chargeable or not chargeable. The following flowchart depicts the tests that help in determining whether the service can be considered to be chargeable or non-chargeable.

For example, following services on an illustrative basis would be considered non-chargeable, considering that it does not satisfy all the tests listed above.

|

Shareholders Activity Services are provided by the parent/holding entity by virtue of its ownership interest in the member entity. Eg: costs relating to reporting requirements, juridical structure, compliance costs |

Incidental Benefits Service performed by a group entity such as a shareholder or coordinating center relates only to some group entities but incidentally provides benefits to other group entities. Eg: benefits received by a group entity due to restructuring of another group entity. |

Duplication Activities are undertaken by one group entity that merely duplicates a service that another group entity is performing for itself. Eg: reorganizing to centralize management functions, taking the second opinion

|

| Members of the group do need such an activity and are not willing to pay for it. Such activities are not considered as Intra-group services as there is no economic or commercial value to the service recipient. | ||

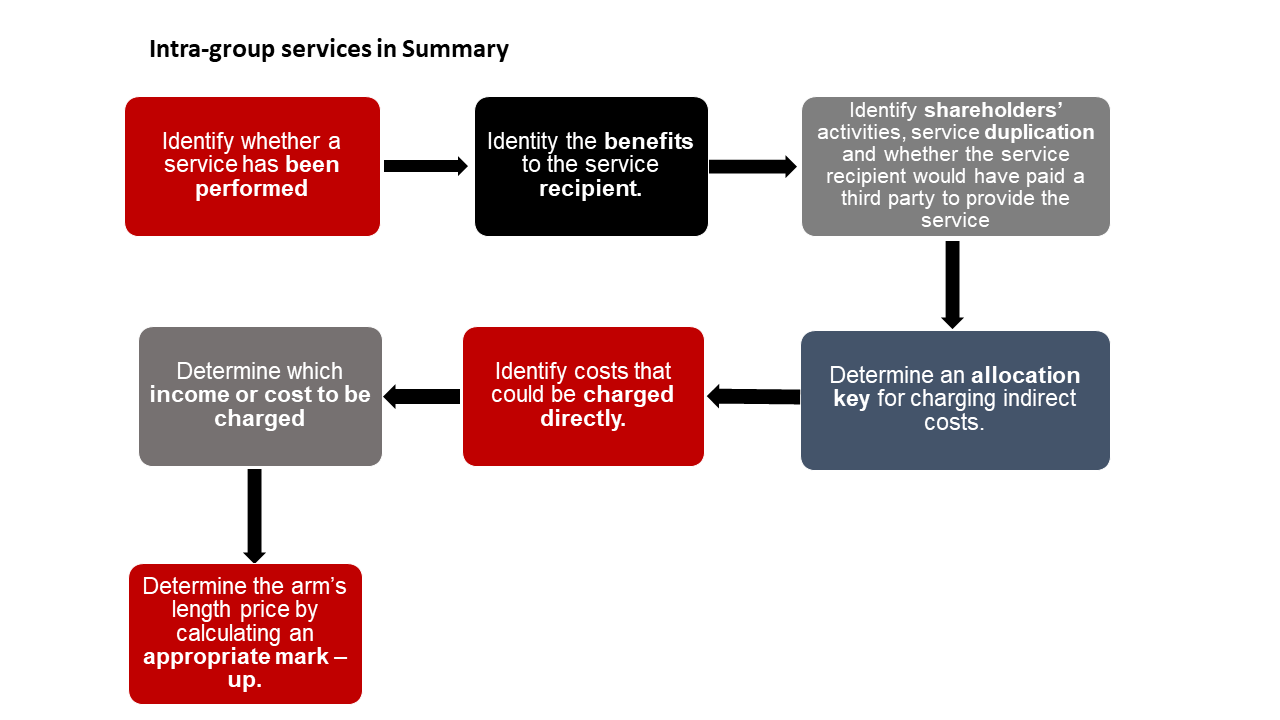

How to calculate the Arm’s length pricing for Intra-group services?

When the service is considered, chargeable post applying the requisite tests, the next question is how much should be the remuneration for such service.

The OECD recommends the following valuation methods for arriving at Arm’s Length Price, considering the outcome of functional analysis (Functions performed, assets employed, and risks assumed) and facts of the case: -

- Direct Charge Method: When the arrangements made for charging for intra-group services can be readily identified or when services are similar to those rendered to associated entities are also rendered to independent parties.

- Indirect Charge method: When the nature of service is such that costs cannot be specially assigned to a particular entity. Eg: central sales promotion activity, administrative services, etc. In such cases, one would be required to use cost allocation and apportionment methods. Viz:

- CUP method: This method compares the price charged for a transaction between unrelated parties to the price charged for a transaction between the related parties in a comparable uncontrolled transaction. Ex: accounting, auditing, legal, etc.,

- Cost plus method: The price is determined by adding to costs, the supplier incurred, and an appropriate gross margin so that the supplier will make an appropriate profit in light of the market conditions and functions he performed. What is obtained after adding markup to costs may be regarded as the arm’s-length price of the originally controlled transactions.

Low value-adding Intra-group services (LVAS)

Further, the OECD also recommends adopting a simplified approach to arrive at an arm’s length price when the services rendered are Low value-adding Intra-group services (LVAS). This is to ease the compliance burden of the businesses.

The OECD considers the services as low value-adding when such services are: -

- supportive in nature,

- not part of the group’s core business,

- not dependent on or contributing to unique and value intangibles, and

- if they do not involve substantial or significant economic risks for the service provided.

The OECD also lists down specific activities that do not qualify to be considered LVAS.

The OECD recommends steps to determine Arm’s Length Price for LVAS, by following an elective simplified process.

How Can ECAG Help?

Our team will assist in analyzing Intragroup services, determining arm’s length prices for Intra-group services, and analyzing for Low value-adding services, or any other matters relating to Transfer Pricing in the UAE.

Feel free to reach out for your Transfer Pricing needs:

CA. Purvi Mehta

Manager – Direct Tax

M: +971 52 2800480 E: purvi@emiratesca.com

CA. Manu Palerichal, FCA, CMA.

Partner & CEO

M: +971502828727 E: manu@emiratesca.com