ESR RAKEZ Notification Due Date is Declared

Economic Substance Notification (ESR Notification) due date is declared for one more Regulatory also. Ras Al Khaimah Economic Zone (RAKEZ) issued Circular on the due date to file the Economic Substance Notification (ESR Notification) and Compliance with the Economic Substance Regulations in UAE (ESR UAE).

The Economic Substance Regulations UAE (ESR UAE) requires certain licensees to comply with Notification & Return filing obligations. The Regulatory Authority, Ras Al Khaimah Economic Zone (RAKEZ) issued the circular for ALL licensees to comply with the submission of Economic Substance Notification (ESR Notification).

Hence he RAKEZ licensees must file the Economic Substance Notification (ESR Notification) on or before 30th June 2020.

Whether all licensees should submit Economic Substance Notification (ESR Notification) in the RAKEZ?

It is to be noted that ALL the Licensee need to file the notification irrespective of whether the Licensee falls into the Exempt Category or has earned any Income in the Reporting Period or not.

What is Economic Substance Regulation?

Economic Substance Regulations UAE (ESR UAE) vide Cabinet of Ministers Resolution No 31 of 2019 is effective in the UAE from the year 2019. This Regulation is applicable to all companies registered in the UAE onshore & Free Zone (including Financial Free Zone) carrying out Relevant Activity. The businesses in the UAE will now have to prove their Economic and Substantial existence in the UAE and have to apply the substance over form approach.

As per Article 8 of this regulation the Licensees need to file Economic Substance Notification (ESR Notification) and Substance Regulations Return (ESR Return) with its Regulatory Authority within the declared due dates.

What are Relevant Activities under Economic Substance Regulations (ESR UAE)?

As per Cabinet Resolution No. 31 of 2019, Relevant Activity means following:

- Banking Business

- Insurance Business

- Investment Fund Management Business

- Lease-Finance Business

- Holding Company

- Headquartered Business

- Shipping Business

- Intellectual Property Business

- Distribution & Service Centre Business

So, the entities must notify the Authority whether or not they carry out any of the above mentioned Relevant Activity. Whether the licensee carries out the Relevant Activity or not needs to be assessed by licensee and Regulatory Authority RAKEZ is not responsible to do any assessment.

Further, it is to be noted that if the Licensee is carrying out the activities which is not mentioned in the license issued by RAKEZ but in substance falls in the category of Relevant Activity, the licensee will have to notify the Authority that it is carrying out the Relevant Activity.

What is to be notified:

As provided in the circular issued by RAKEZ, ALL the Licensee must file the Economic Substance Notification (ESR Notification) with the Authority. The details in Economic Substance Notification (ESR Notification) includes the following details:

· Licensee details

· Financial Year-end Period

· Reportable Period

· Relevant Activities

· Whether Licensee falls in Exempt category, or whether the Licensee is Tax Resident outside UAE during the Reportable Period.

· Declaration

What is Exempt Category?

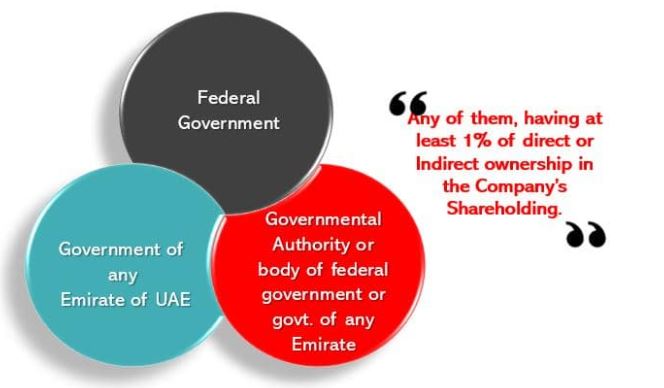

A Licensee is said to be Exempted from Economic Substance Regulations UAE (ESR UAE) if at least 51% of the share capital of the Licensee is directly or indirectly owned by the UAE Federal Government, or the Government of any Emirate, or any governmental authority or body of the UAE Federal or an Emirate Government during the Reportable Period.

What if the licensee does not fall in Exempt Category and also conducts the Relevant Activity?

For Licensee who are not Exempt from ESR and conducts the Relevant Activity in the Reporting Period and also earns Income will have to Comply with the following:

- Meet the Substance Requirements as provided in Article 6 of the Cabinet Resolution No. 31 of 2019, Economic Substance Regulations UAE (ESR UAE),

- To submit the Economic Substance Return (ESR return) with RAKEZ well within the Due date (yet to announce).

What are the penalties in cases of Non-compliance?

If any licensee fails to comply with the requirement of filing the Economic Substance Notification (ESR Notification), then such Licensee may have to face Penal Consequences as provided in Article 11 of the Cabinet Resolution No. 31 of 2019. The penalty ranges from AED 10,000 to AED 50,000 in the first year of its Non-Compliance and for Subsequent non-compliance, it ranges from AED 50,000 to AED 300,000

. Further, failure by an Entity to comply with Economic Substance Regulations UAE (ESR UAE) can also result in potential suspension, revocation or non-renewal of its registration as provided in Article 10 of the Cabinet Resolution No. 31 of 2019.

What can we do for you?

We Emirates Chartered Accountants Group have a specialized team on the Subject to support and guide you on the Compliance with Economic Substance Regulation with the following roadmap:

Phase I:

To study your Business Activities in detail and assess the applicability of Economic Substance Regulation on your activities. Also, to provide support and guidance on filing a notification with the Relevant Authority.

Phase II:

To provide guidance and support for compliance with the provisions of the Regulation if your activity is falling under the regulation. To conduct Impact Study and Gap Analysis in order to assess whether the Business meets the Compliance test and to provide the recommendations.

Phase III:

Reporting with Relevant Authority on or before the Due Date. At Emirates Chartered Accountants Group, we have quality-driven professionals who are well versed with practical knowledge of assisting businesses with the applicability of Economic Substance Regulation in the UAE & Bahrain. They shall help you determine the applicability of this law and support you with Economic Substance Notification for your business.

For any enquiry and support on Economic Substance Regulation,

you can reach out:

CA Dhara Yagnik, M.Com, ACA

dhara@emiratesca.com

+971565956836

CA. Manu Palerichal, FCA, CMA

manu@emiratesca.com

+971502828727