Categories of Goods & Services under VAT in UAE.

The UAE is going to implement a 5% VAT from 1st January 2018. VAT is a type of general consumption tax that is collected incrementally, based on the value-added, at each stage of production or sales. It is a kind of consumer tax where the end-users will be paying the desired rate of VAT. VAT is also known as goods and services tax (GST) in some parts of the world.

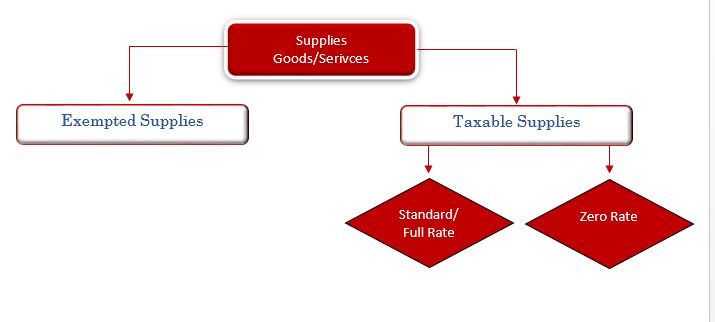

There are two types of Supplies in the UAE VAT, such as:

- Exempted Supplies and Taxable Supplies.

- Taxable Supplies has been further classified to zero-rated and standard/full rated.

UAE VAT is classified as below:

-

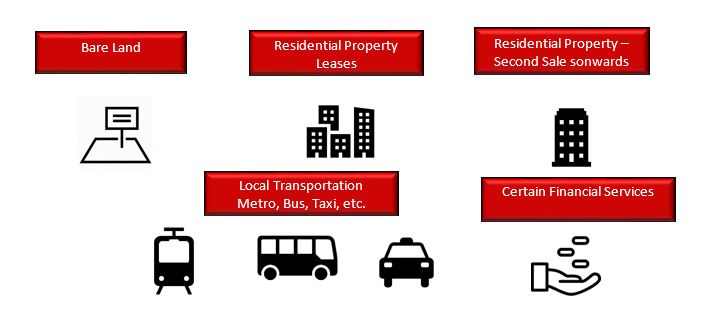

Exempt Supplies

Exempt Supplies are those kinds of supplies which are unaffected by VAT implementation in the UAE. Tax amount is not charged on such supplies. Hence, the input tax in the exempt supply cannot be deducted. Following are the common Exempt Supplies under the UAE VAT

-

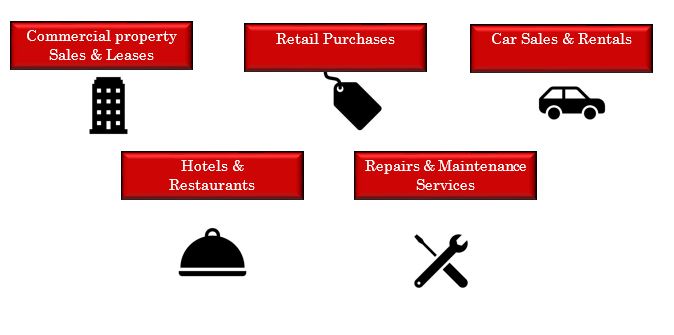

Taxable Supplies:

Standard Rate or Taxable supplies are those supplies which will have an impact of 5% VAT in the UAE. For Standard Rate supplies, input Vat can be deducted as there is 5% VAT. We can claim VAT to the Federal Tax Authority for Standard Rated supplies. Following are the Taxable Supplies or Standard Rated Supplies under the UAE VAT:

-

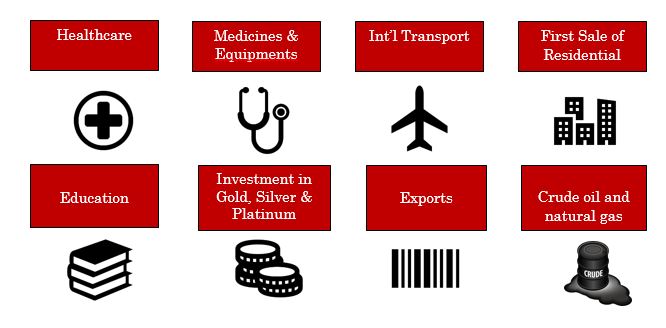

Zero Rated

Zero-Rated Supplies are those supplies on which the rate of VAT is 0%. But in zero-rated supplies input tax, can be deducted.

Looking for TAX Services in the UAE?

We provide:

- Tax Agent’s Service

- VAT Return Filing

- VAT Service

- VAT Registration

- Excise Tax Service

- VAT Deregistration

For Tax Services in Dubai:

Mr. Pradeep Sai

sai@emiratesca.com

+971 – 556530001

For Tax Services in Abu Dhabi:

Mr. Vinay. E. R

vinay@emiratesca.com

+971 54 378 44140

For Tax Services in Northern Emirate (Sharjah, Ajman, RAK, Fujairah)

Mr. Praveen

praveen@emiratesca.com

+971 – 508873115