Failure to keep up with the changing requirements can lead to penalties and legal consequences.

An effective framework should be developed based on the guidelines provided by the regulator in compliance to the Federal Law 20 of 2018 and Federal Law 26 of 2021 amending certain provisions of Federal law 20, Cabinet Decision No. 10 of 2019, Cabinet Decision No. 58 of 2020, Cabinet Decision No. 74 of 2020 and the various guidelines, circulars, notices, and standards issued from time to time.

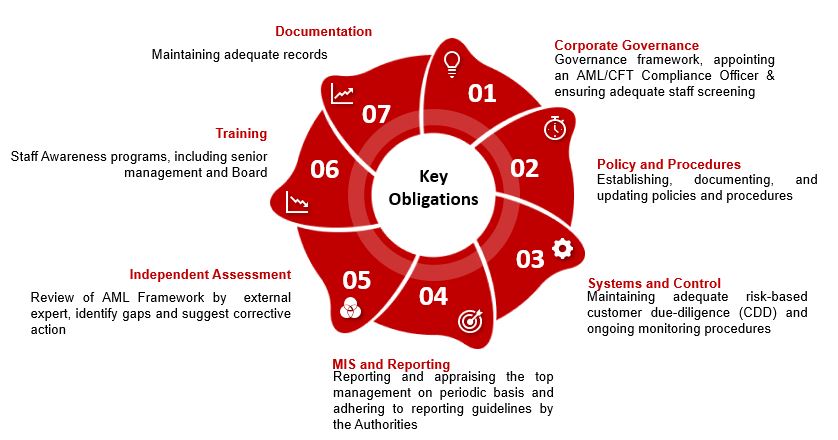

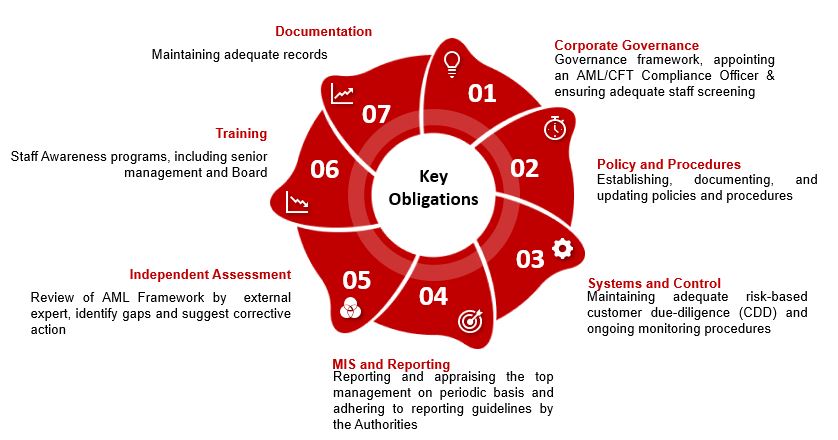

The pillars that help to build an effective AML/CFT Compliance Program can be categorized as under:

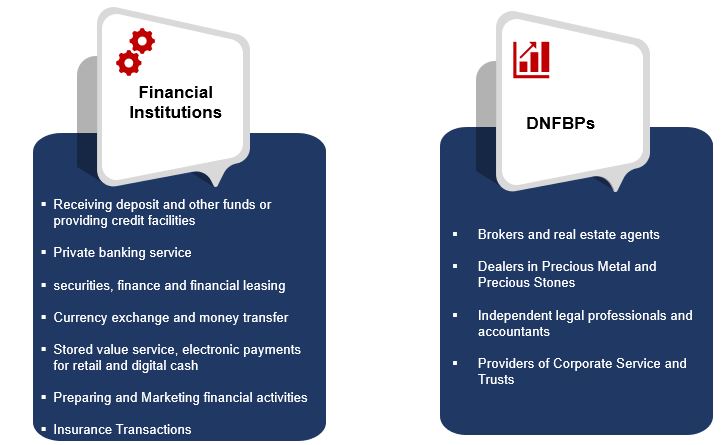

The team of experts at Emirates Chartered Accountants Group can assist in developing, implementing, and enhancing compliance regimes across sectors, viz:, Designated Non-Financial Businesses and Professions (DNFBP), Banking, Insurance, Exchange Houses, etc.

Our range of services includes:

AML Policy and Procedures:

- Designing, Reviewing, updating AML / CFT Policy and Procedures

- Drafting of AML/CFT Policy and Procedures manual

- Review and updation of existing AML /CFT Policy and Procedures

- Drafting of Anti-Bribery and Anti-corruption Policy

Risk Assessment and Risk Profiling:

- Review of customer risk assessment methodology

- Assisting in the development of customer risk assessment model considering NRA guidelines

- Assisting in preparation of Risk Register - Risk identification and mitigation

AML/CFT Health Check

- Gap Assessment

- Periodic review of onboarding documentation and transactions

AML IT Systems

- Assistance in the selection of appropriate AML/CFT software

- Conduct software demos

- Review of existing core solutions, risk profiling, screening, and monitoring software solutions

Compliance Assistance:

- Assistance in registration on the GoAML Portal

- Guidance to AML Compliance Officer for performing his day to day function

- Assistance in conducting EDD for High-risk customers

- Assistance in preparation of statutory reports

- Assistance in Screening of customers and counterparty

- Conducting Audits/reviews as per statutory requirements, including agreed-upon Procedures Audit (AUP Audit)

- Assistance in preparation of documentation standards

AML Awareness Program:

- Conducting AML/CFT awareness program for staff

- Conducting AML/CFT awareness program for Senior Management and Board of directors

- Conducting role-specific awareness programs covering Screening, Transaction Monitoring, Due Diligence, etc.