- May 18,2020

- All | Audit / IFRS

Cash Flow Management & Working Capital Management

In the present scenario, most of the companies are discussing how to handle cash flow management during the crisis. There is no prefixed solution which can be applied to all the industry/client. It depends on various factors like the type of business, inventory requirements, purchase lead time, manufacturing cycle, relationship with your suppliers/ trade creditors, credit policies with your service providers, support from your Finance partners, periodic financial commitments to the lenders, operating segment, etc. It can be analyzed based on the industry it belongs to, the current market situation and the business strategy of that particular business/client.

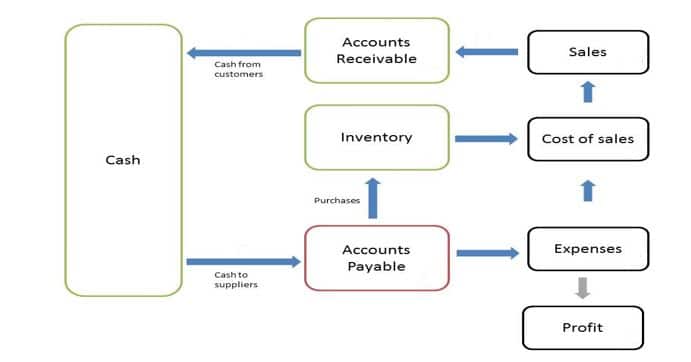

When we are discussing Cash Flow Management, we have to analyze our working capital management. It is the difference between Current Assets (Cash + Inventory + Accounts Receivable) – Current Liabilities (Accounts Payable + Short Term Borrowing + Accrued Liabilities).

It is essential to study the working cycle from procurement of raw material/inventory till payment made to the suppliers, i.e., point at which the company procures a stock of raw material till payments received from sale and payment made to the suppliers.

This conversion cycle and the numbers of days are very relevant for the analysis of working capital management. Based on this analysis, the finance team can identify the working capital gap and plan to source the fund to fill the gap.

4 Ways To monitor & improve Cash Flow Management & Working Capital Management gap during the crisis

- Prepare the cash flow management on an Annually/semi-annually/ monthly/weekly/daily basis.

Usually, the Finance team used to prepare the cash flow management every month to get control of cash inflow and outflow. In the present situation, most of the business units are facing a cash crunch, and there is a high probability for the delay in receipt. As everyone knows, we can’t prepare a negative cash flow, and we can spend it based on the availability of cash only. Based on the present situation, it is advisable to make the cash flow on a weekly/daily basis.

- Accounts/Trade Receivables.

Recheck the creditworthiness of your client/customer through reliable sources/credit rating agencies. Apply some easy payment plan for overdue payments, cash discounts for early payment, trade discounts, etc. to get the cash flow in. If you have Bank credit lines/working capital limits, check the possibility of factoring of a customer invoice, PDC discounting, Pre-shipment/Post Shipment Financing, etc.

In the case of contracting a company having a confirmed project to execute and the project is backed by a confirmed Letter of Credit (LC), the client can approach the bank for Project Financing. In project financing, the client has to submit the project cash flow in advance and the confirmed order to the bank.

If the company is having an existing credit facility with the bank and have a strong financial position based on the risk of the project, profitability, cash flow from that particular project and the creditworthiness of the end customer bank may provide Project finance which will help the client to execute the project without having any cash flow management issues.

In the project, the finance bank may be ready to issue a performance guarantee, advance payment guarantee, retention bonds, supplier payments, and bank overdraft/term loan to meet the immediate financial commitments. Bank may request to assign the payment directly that particular bank account to monitor the particular project cash flow. Since there is a confirmed Letter of Credit from the end-customer, the risk factor is minimal as far as the bank is concerned.

- Payment to Vendor/Suppliers/Banks.

It is always advisable to have a good relationship with your suppliers/vendors. Explain the business model you are into and let them also be aware of your customer habits/credit policy/terms. It will help you to fix the credit policy with your supplier. You are the representative of your supplier in the local region/area.

So, you are taking some portion of the risk to promote the product of your supplier. Collection from the customer is your responsibility, and you are liable to settle to your supplier even if your customer didn’t pay to you.

So when you are negotiating payment terms with the supplier, please take into consideration the market risk, liquidity, and financial risk. Try to keep the risk at the minimum level.

In the present market situation, it is always better to request your supplier to extend the credit period to get some relaxation on your cash flows. Try whatever is in our control before we approach external financial sources/Lenders.

If you have credit lines with the banks, inform the present cash flow situation to the banker, and convince them. Bank may extend the settlement period/date, taking into consideration your payment history, facility utilization, business segment, etc.

According to the Central Bank of UAE (CBUAE), the UAE’s banking sector is actively participating in the Targeted Economic Support Scheme (TESS) by supporting individuals small and medium-sized enterprises (SMEs) and other private corporates affected by COVID-19 pandemic. (Gulf News)

As per Central Bank of UAE, those eligible customers impacted by the effects of the pandemic will not be required to pay their respective bank any instalments, consisting of principal and/or interest/profit, for the agreed deferment period.

However, any interest/profit accrued during the deferment period on the principal amount will be paid by the customer at a later date to be agreed upon with their respective bank. Banks should not charge any interest/profit on the deferred interest/profit amounts, as per the conditions set by the CBUAE. (Gulf News)

As part of its ongoing mandate to safeguard consumers, the CBUAE developed detailed regulations and guidelines in relation to the TESS. Banks are urged to process more applications from individuals, corporates, and SMEs whose business operations are affected by the implications of COVID-19 pandemic, and banks are expected to retain sound lending standards and are required to treat all their customers fairly. (Gulf News).

- Payment towards Expenses.

Prioritize your cash outflow related to operating expenses. Analyze and monitor all the costs/cash outflows, which are very important for business operations, and the non-payment may affect the discontinuance of the service/support.

One shall check if there is any chance to cut down the expenses depends on nature/ cash outflow/ requirements and vouch how short term cashflow benefits the business as well as expenses reduction, which will help in the long term survival.

Also, see if there is any best alternate to replace or reduce the current costs/ cash outflow and analyze the opportunities to manage the expenses internally without cash outflow, analyze the expenditures based on nature of importance, etc., which will help to sustain the businesses in the present situation.

Emirates Chartered Accountants Group provides business process restructuring services to analyze and redesign the Cash Flow Management & Working Capital Management gap during the crisis to optimize end-to-end processes and eliminate non-value-added tasks.

Our process experts shall review and benchmark your business processes against best practices and recommend changes in the processes to:

- Increase efficiencies in overall business operations.

- Improve controls

- Save time and costs

- Enhance the level of governance

For Business Process Restructuring Services In The UAE

CA Navaneeth